JFE Holdings to Sell Warehousing Property in Kawasaki’s Ogimachi Area to Nitori

JFE Holdings, Inc.

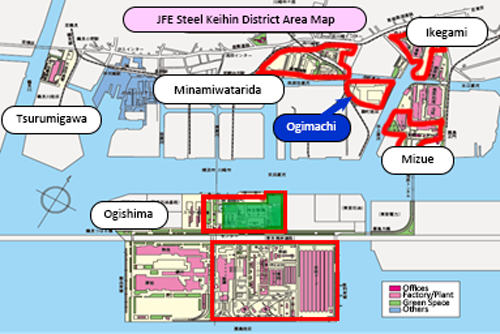

JFE Holdings, Inc. announced today that it will sell an approximately 21-hectare property in Kawasaki city’s Ogimachi waterfront area to furniture and home accessory retailer Nitori Co., Ltd. The property, which is currently leased out for warehousing as one of many noncontiguous sites managed by JFE Steel’s East Japan Works, is located in the works’ Keihin District, where JFE has been studying possible redeployments of various properties.

Proceeds from the sale, the value of which will not be disclosed, will be used to fund future investments by JFE.

JFE Steel is preparing to shut down a blast furnace and other production-related equipment in the Ogishima area of the Keihin District by this coming September. Ogishima and additional properties in the nearby areas of Minamiwatarida, Mizue and Ikegami, as well as Ogimachi, are expected to be repurposed for sale, lease or new business use.

JFE Holdings entered into an agreement with the Kawasaki city government on February 1, 2021 to jointly study, together with the city and related organizations, options for repurposing local-based properties. The plan that the parties have been devising will be announced this September when JFE Steel officially shuts down its blast furnace and other equipment in the company’s Keihin District.

Going forward, JFE Holdings will continue to pursue redeployments of its Keihin properties in order to maximize corporate resources and initiatives for the sustainable long-term growth of the company’s business and its enterprise value.

Location of Ogimachi

Related information

・ENEOS, JERA, and JFE Holdings to Begin Joint Study of a Hydrogen and Ammonia Supply Collaboration Based at the Keihin Waterfront Area

Attachment

Overview of property to be divested

• Property

| Location | Size | Gain on sale | Current status |

| Ogimachi, Kawasaki-ku, Kawasaki, Kanagawa Prefecture | 207,913m2 | Around 45 billion yen | Warehousing facility |

Pursuant to an agreement with the purchaser, the sale price and book value will not be disclosed, but the sale will be made at an appropriate price that reflects market value.

The listed gain on sale is an estimate obtained by deducting the book value and estimated costs of sale from the purchase price.

• Purchaser

| Name | Nitori Co., Ltd. |

| Head office | 1-2-39 Shinkotoni 7-jo, Kita-ku, Sapporo, Hokkaido Prefecture, Japan |

| CEO | Masanori Takeda |

| Main business | Development and sale of furniture and home accessories, incl. interior decorations for new homes, some developed overseas and imported into Japan |

| Capital | 1 billion yen |

| Establishment | March 1972 |

| Net assets | 284.4 billion yen (Feb. 20, 2022) |

| Total assets | 386.2 billion yen (Feb. 20, 2022) |

| Owner | Nitori Holdings Co., Ltd. (100%) |

| Relationships | Nitori and JFE Holdings do not currently share any capital, personnel, business or third-party relationship requiring disclosure. |

• Schedule

| Resolution by JFE board | March 7, 2023 |

| Contract conclusion (tentative) | End of March 2023 |

| Property delivery (tentative) | Late December 2024 |

• Outlook

Delivery of the fixed assets is scheduled for Dec. 2024. JFE Holdings expects to recognize a gain of around 45 billion yen in its consolidated financial statements for the fiscal year ending March 31, 2025.

# # #

- For more information about this project, please contact:

-