Scenario Analysis in Line with the TCFD Recommendations

Initiatives

The JFE Group intends to achieve carbon neutrality by 2050, and it leverages the scenario analysis in line with the TCFD recommendations to identify and assess climate change-related risks and opportunities and to strengthen the resilience of its organizational strategy. Please refer to the Initiatives to Address Climate Change Issues page for governance, strategy, risk management, metrics, and targets for climate change-related issues in line with the TCFD recommendations.

Milestones Related to Climate Change around JFE’s Business and JFE’s Initiatives

| 1997 | Kyoto Protocol adopted at COP3 in Kyoto |

|---|---|

| 2008 | JISF’s Voluntary Action Plan launched |

| 2013 | JISF’s Commitment to a Low Carbon Society launched |

| 2015 | Paris Agreement adopted at COP21 |

| 2017 | TCFD published the final report of its recommendations |

| 2018 | JISF announced the Long-term Vision for Climate Change Mitigation, Zero Carbon Steel |

| 2019 | JFE Group announced its endorsement for the final report of the TCFD recommendations JFE Group published a scenario analysis in line with the TCFD recommendations |

| 2020 | Keidanren launched the Challenge Zero initiative Ministry of Economy, Trade and Industry published a list entitled Companies Taking on the Zero-Emission Challenge JFE Group published its targets in its medium- to long-term vision (target for 2030 and achieving carbon neutrality by 2050) Prime Minister Suga declared Japan will achieve carbon neutrality by 2050 |

| 2021 | JISF announced the Basic Policy of the Japan Steel Industry on 2050 Carbon Neutrality Aimed by the Japanese Government JFE Group published its roadmap for achieving carbon neutrality in 2050 in the JFE Group Environmental Vision for 2050 Japanese government formulated the Green Growth Strategy Through Achieving Carbon Neutrality in 2050 |

| 2022 | JFE Group announced that the CO2 emissions reduction target for FY2030 for JFE Steel has been revised upward to 30% or more compared to FY2013 JISF published the “Evaluation of the Phase I Target (FY2020 Target) ” and Phase II (FY2030 target) of reducing the total volume of energy-related CO2 emissions by 30% in its “Activities to Combat Global Warming—Report of JISF’s Carbon Neutrality Action Plan (Commitment to a Low Carbon Society) (March 2022).” |

| 2023 | The Act Concerning the Promotion of a Smooth Transition to a Decarbonized Economic Structure (the “GX Promotion Act”) was enacted. |

The Challenge Zero (Innovation Challenges Toward a Net Zero Carbon Society) is a new joint initiative by Keidanren (Japan Business Federation) and the Japanese government for proactively publicizing and supporting companies and organizations that pursue innovative actions toward realizing a decarbonized society as the long-term goal of the Paris Agreement.

The JFE Group endorses the Challenge Zero declaration and will rise to the challenge of pursuing innovation.

The Ministry of Economy, Trade and Industry (METI), in collaboration with Keidanren and the New Energy and Industrial Technology Development Organization (NEDO), has been tackling a project called the Zero-Emission Challenge. The project is preparing a list of companies generating innovation toward realizing a decarbonized society and providing investors and other stakeholders with useful information on them. At the TCFD Summit 2021 on October 5, 2021, approximately 600 companies, both listed and unlisted, were announced as Zero Emissions Challenge Companies. These organizations are boldly accepting the challenge of innovation to realize a decarbonized society, and the JFE Group was selected as one of them.

The JFE Group publishes information on specific initiatives through the following website.

Scenario Analysis

Tools and Methods

Scenario analysis is used to portray an accurate understanding of climate-related risks and opportunities and assess implications to the current business strategy, thereby enabling an organization to establish strategies that reflect the results of the assessment. As our business could be significantly affected by climate change, we have created both a 2℃ scenario and a 4℃ scenario. In FY2022, we expanded the scope to also include a 1.5℃ scenario.

All three scenarios are based on those developed by the International Energy Agency (IEA). Analysis was conducted under the assumption that uniform carbon pricing is implemented by major emitting countries to increase the feasibility of achieving the 1.5℃ target.

Under the long-term scenario analysis, our goal is to achieve carbon neutrality by 2050. We conducted risk assessments that take into account the prospect of achieving the 2℃ scenario and the necessity of ultra-innovative technology for the 1.5℃ scenario (IPCC 1.5℃ Special Report) in steelmaking for carbon neutrality by 2050.

| Selected Scenario | 1.5/2℃ Scenario | 4℃ Scenario | |

|---|---|---|---|

| Reference Scenario | Transition Risks |

Transition scenarios developed by the IEA

|

Transition scenarios developed by the IEA

|

| Physical Risk |

Climate change projection scenario developed by the Intergovernmental Panel on Climate Change (IPCC)

|

||

| How Society will Look |

Dynamic policies will be adopted and technical innovations will progress to limit the average temperature rise by the end of this century to 1.5/2℃ and realize sustainable development.

|

Despite new policies implemented in each country based on approaches under the Paris Agreement, the average temperature will rise by about 4℃ by the end of this century.

|

|

- *1Source: IEA’s World Energy Outlook 2018

- *2Source: IEA’s Energy Technology Perspectives 2017

- *3Source: IEA’s Net Zero by 2050—A Roadmap for the Global Energy Sector

- *4Source: IPCC Fifth Assessment Report

- *5When carbon pricing differs from country to country, a gap opens in international competitiveness between countries that impose strict CO2 emissions regulations and those with less strict regulations. This will result in carbon leakage where CO2 emissions of a strict climate policy country are reduced as production and investment decline while production and investment increase in other countries with laxer emission constraints, thereby increasing their nations’ CO2 emissions. One reference scenario, SDS, assumes the implementation of carbon pricing in developed countries and some developing countries. We took this into account in formulating the 2℃ scenario based on the assumption that uniform carbon pricing is introduced to major emitting countries to push toward achieving the 2℃ scenario target.

Scope of Business and Period for Analysis

This analysis covers the following businesses: the steel business by JFE Steel, the engineering business by JFE Engineering, the trading business by JFE Shoji, and businesses carried out by some of the other Group companies. The period covered is up to 2050.

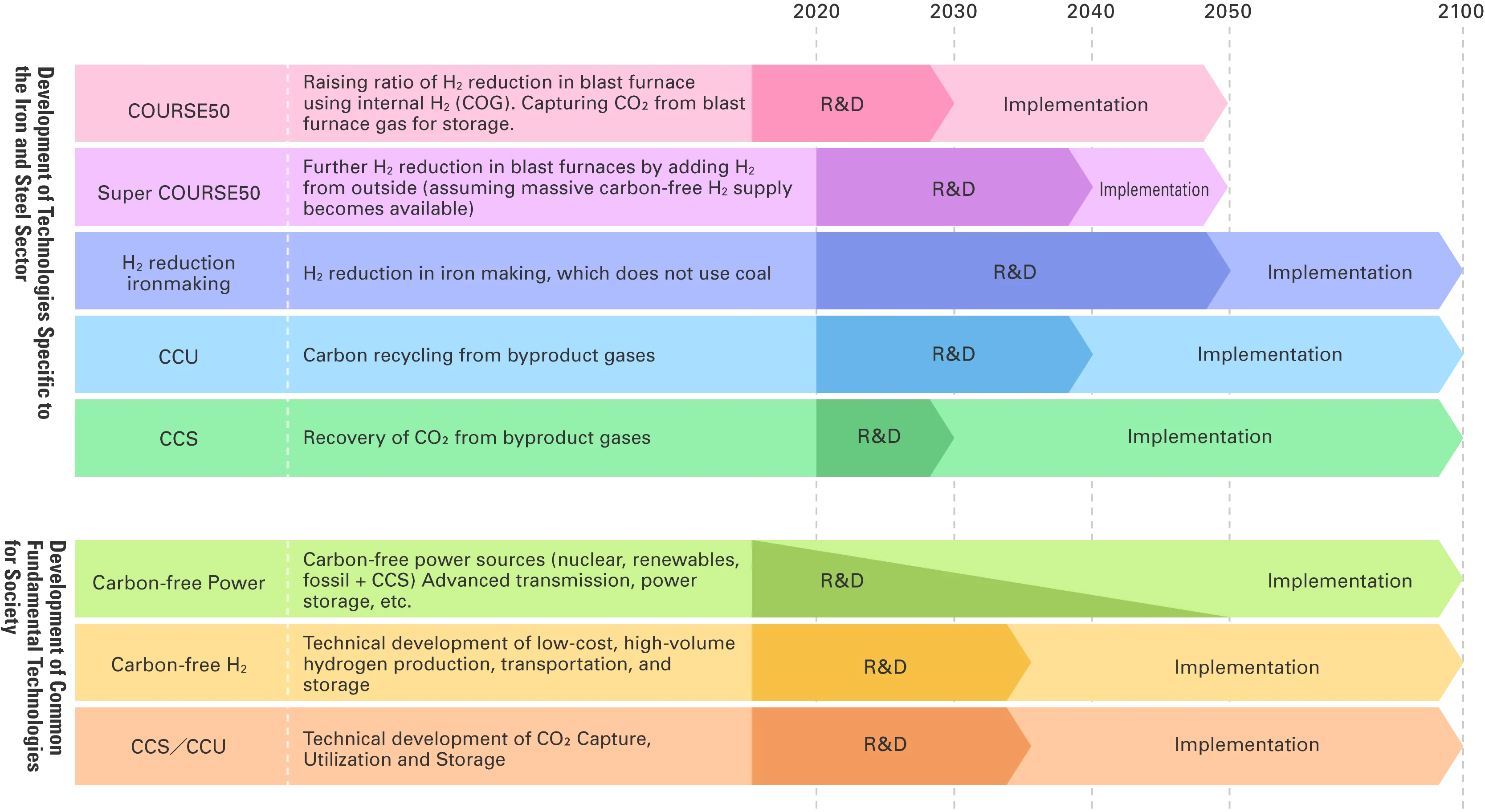

Relevance with the JISF’s Long-term Vision for Climate Change Mitigation

The Japan Iron and Steel Federation (JISF) has been working toward its Commitment to a Low Carbon Society, and Phase I of this initiative ended in FY2020. From FY2021, the effort was rebranded as the Carbon Neutrality Action Plan, and the Phase II target (FY2030 target) was revised. In November 2018, the JISF also formulated and published the Long-term Vision for Climate Change Mitigation for 2030 and beyond. JFE Steel played a central role in the formulation of this long-term vision. The vision represents the industry's challenge toward realizing zero-carbon steel and lays out the prospect of achieving the 2℃ scenario for steelmaking and necessity of ultra-innovative technologies to achieve the 1.5℃ scenario. Furthermore, on February 15, 2021, the JISF announced the “Basic Policy of the Japan Steel Industry on 2050 Carbon Neutrality Aimed by the Japanese Government,” which declares that the Japanese iron and steel industry will boldly accept the challenge of realizing zero-carbon steel.

The JFE Group’s scenario analysis is intended to ensure resiliency in our Group's business strategy during the intermediate stages of these long-term challenges.

Efforts to Achieve Zero Carbon Steel

Process to Identify Key Factors that Impact the Business

| STEP1: | Examine the entire value chain from a holistic perspective and sort out factors that impact the businesses under analysis (for more information on risks and opportunities in the value chain, refer to: JFE Group Value Chain) |

|---|---|

| STEP2: | Examine all factors at an overview level and identify key factors by taking into account the level of impact and stakeholder expectations and concerns |

| 1.5/2℃ Scenario | 4℃ Scenario | |

|---|---|---|

| Impact on Procurement |

|

|

| Impact on Direct Operation |

|

|

| Impact on Product and Service Demand |

|

|

| Axis for identifying key factors: | ●Level of impact (possibility of risks and opportunities arising x Level of impact if manifested) |

|---|---|

| ●Expectations and concerns of stakeholders |

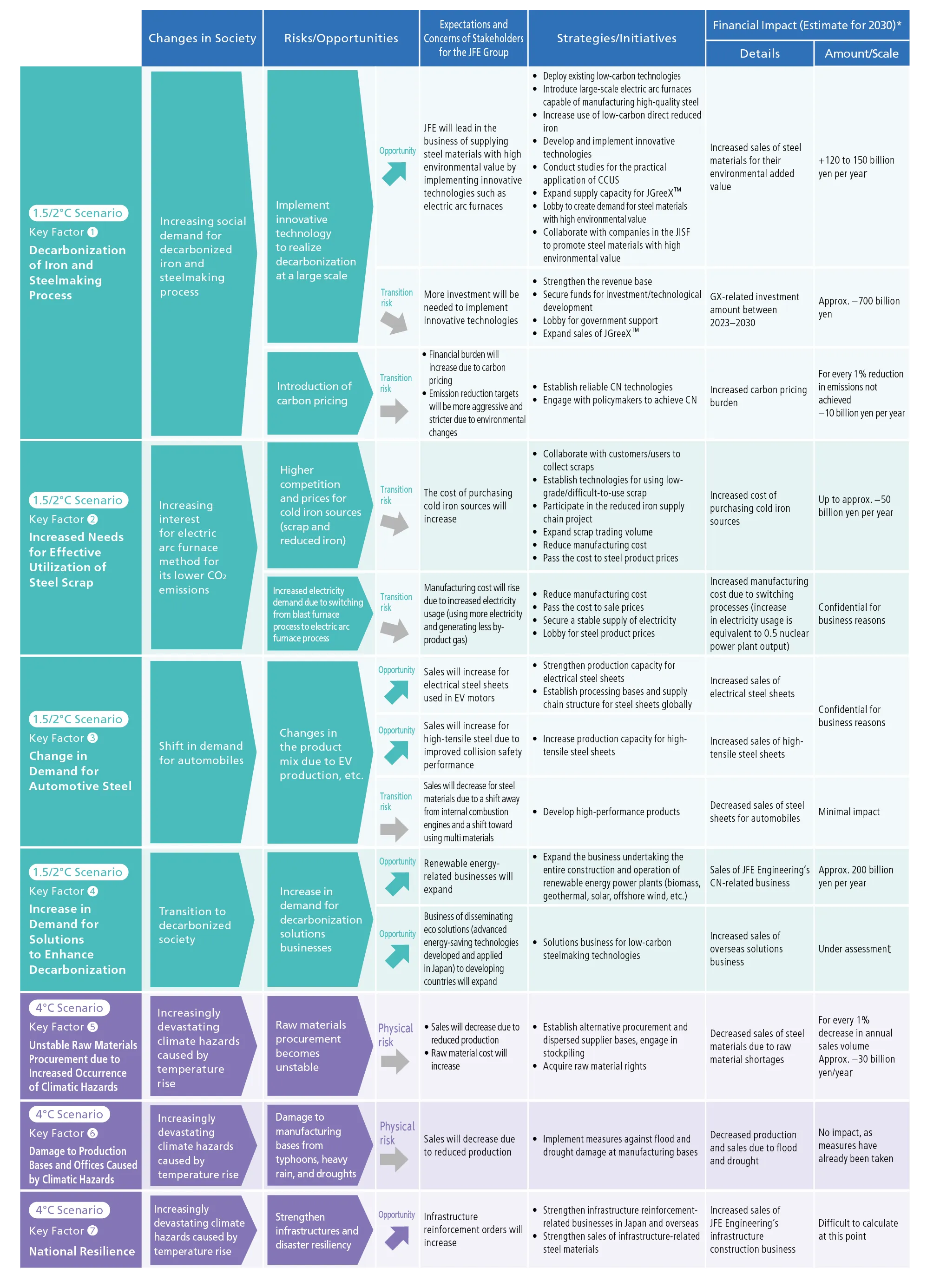

Results of Scenario Analysis

Climate change is a critical concern from the perspective of business continuity for JFE Group management. Our steel business, which emits 99.9% of the Group’s total CO2 emissions, has been developing technologies for saving energy and reducing CO2 emissions. We have actively addressed the risks by applying these technologies to steel manufacturing. We will continue to develop processes to further reduce environmental impact while at the same time seeking to turn this challenge into an opportunity for addressing climate change by deploying the technologies we have fostered across the globe.

The JFE Group has developed and maintained a variety of eco-friendly products and technologies, including high-performance steel materials that help save energy when customers use them, as well as renewable energy power generation. We view the current challenges as an opportunity and are contributing to addressing climate change. As automobiles in general become lighter in weight along with the broader adoption of electric vehicles, we will support the transition by improving the functions of the JFE Group’s high tensile strength steel sheets and electrical steel sheets. In addition, we will help reduce CO2 emissions in society by further disseminating renewable energies and implementing recycling initiatives as well as energy conservation.

To achieve the long-term goal of the Paris Agreement of keeping the global average temperature increase well below 2℃ compared to pre-industrial levels and to strive to limit it more strictly to 1.5℃, the Group will continue to develop and disseminate innovative technologies and contribute to the prevention of global warming. We will also support national resilience by providing steel for social infrastructure and construction to address the emerging risks associated with the growing severity of meteorological disasters.

Analysis Results

- Note: Assessment results are estimated outcomes based on scenario analysis and do not represent actual performance.

Overview of Scenario Analysis Assessment and JFE Group’s Focus

Timeframe: short term (2024) ⇒ until 2024, medium term (2030) ⇒until 2030, long term (2050) ⇒until 2050 (final)

FOCUS Key Factor (1) Decarbonization of Iron and Steelmaking Process

Supply steel materials with high environmental value through implementation of innovative technologies such as electric arc furnaces

Short term (2024) Medium term (2030)

JFE Steel has been committed to developing energy-saving technologies toward increasing the efficiency of the iron and steelmaking process and decarbonization. These initiatives have helped JFE Steel acquire technologies that realize the world’s top energy efficiency in iron and steelmaking. Taking advantage of the increasing public demand for decarbonized iron and steelmaking processes, we will deploy these low-carbon technologies at each of our steelworks and expand our capacity to supply steel products with high environmental value that are manufactured using these technologies. The rising worldwide support for decarbonization is expected to drive greater demand for low-CO2 emission steel products, such as in the automobile industry, where CO2 emissions must be managed throughout the supply chain. In the IEA’s Net Zero Emissions by 2050 Scenario (NZE), the share of steel production using electric arc furnaces is expected to increase to 37% by 2030 and 53% by 2050. Since steel production using electric arc furnaces emits less CO2 than using blast furnaces, customer demand may shift to products manufactured using the former. During the transition period, we are considering the introduction of large-scale electric arc furnaces capable of producing high-performance, high-quality steel materials that could only be made previously using the blast furnace process. In addition to meet customer needs for products that reduce environmental impact, in the first half of FY2023 JFE Steel began supplying JGreeX™, a brand of green steel products that significantly reduce CO2 emissions in the steel manufacturing process compared to conventional products. At present, it is difficult to immediately supply green steel products with significantly lower or zero emissions, so the reductions created by our technologies are allocated to any steel products by applying the mass balance method and then supplied as green steel products. Reduction of CO2 throughout the supply chain is rapidly progressing and JFE Steel will contribute to the decarbonization of society by expanding its capacity for supplying JGreeX™ and further reducing CO2 emissions through the use of advanced low-carbon technologies as well as energy-saving, high-efficiency technologies.

Moreover, further progress in these initiatives will depend on gaining broader recognition of the environmental value of these steel materials. We are also actively lobbying to boost demand for steel materials with high environmental value.

Long term (2050)

In the long term, we will develop carbon-recycling blast furnaces (CR blast furnaces), hydrogen steelmaking, and electric arc furnaces while striving to achieve carbon neutrality by 2050, as stated in the JFE Group Environmental Vision for 2050. In particular, we have been focusing on a technology that combines a CR blast furnace with CCU. This is an ultra-innovative technology that targets net zero CO2 emissions by drastically reducing CO2 emissions from the blast furnace process, maximizing its ability to efficiently produce high-grade steel in mass volume, and enabling CO2 reuse in the blast furnace. The remaining CO2 that cannot be fully reused in the furnace will be further reduced by manufacturing basic chemicals such as methanol.

More investment needed to implement innovative technologies

Short term (2024) Medium term (2030)

The investment need to implement innovative technologies such as electric arc furnaces presents a risk. In order to achieve the CO2 reduction target for FY2030, we are assuming that investment and financing on a scale of 1 trillion yen may be required, and we have approved approximately 300 billion yen from FY2021 to FY2023. We are working to strengthen our revenue base, carry out research and development using the Green Innovation Fund and other sources, lobby for government support, and expand sales of JGreeX™ to continue making these capital investments.

Long term (2050)

International expectations have been rising for organizations to seek pathways for achieving the 1.5℃ scenario. We believe the necessary actions are not significantly different from the 2℃ scenario. In the 1.5℃ scenario, however, the development and implementation of decarbonizing technologies would need to further accelerate, requiring significantly more R&D costs and capital investment. A public infrastructure capable of supplying cheap and ample green hydrogen and electricity would also need to be in place. We believe that addressing these issues will require more support from the government and collaboration across society, including a mechanism for broadly sharing the financial burden and a long-term government strategy for supplying green hydrogen and electricity.

Financial burden will increase due to carbon pricing, and emission reduction targets will be more aggressive and stricter due to environmental changes

Short term (2024) Medium term (2030) Long term (2050)

Various approaches to carbon pricing have been introduced around the world, and in Japan, emissions trading and the introduction of growth-oriented carbon pricing are being discussed in line with the GX Promotion Law for achieving carbon neutrality by 2050. In Europe, the introduction of a border adjustment tax (CBAM regulation) is being discussed, and ahead of its full application from 2026, the transitional phase started on October 1, 2023, in which reporting obligations are imposed on importers of goods in scope. Countries are taking different approaches to pricing carbon, and the scope of the levies also differ. While carbon pricing still involves many moving parts, we need to closely monitor future trends and consider the impact of these changes. On the other hand, we also believe that carbon pricing could be an important system for ensuring that steel products with environmental value are properly evaluated worldwide. We are recommending that the government takes steps to ensure that the system is appropriately designed.

FOCUS Key Factor (2) Increased Need for Effective Utilization of Steel Scrap

Cost of purchasing cold iron sources (scrap/reduced iron) will increase

Short term (2024) Medium term (2030) Long term (2050)

There is a growing interest in the electric arc furnace process because of its low carbon footprint, and its adoption is progressing worldwide. Even as the JFE Group takes full advantage of its electric arc furnaces, it is installing these furnaces at the Chiba District of the East Japan Works and also considering installing a large electric arc furnace at the Kurashiki district of the West Japan Works. We expect that demand for cold iron sources (scrap and reduced iron) will increase, and there is a risk it will become difficult to procure the cold iron sources necessary to maintain the quality of steel and maintain production. To this end, we are working to ensure a stable supply by collecting high-grade scrap generated by our customers and developing technologies for using low-grade or difficult-to-use scrap. In addition, we are striving to ensure the stable procurement of direct reduced iron through our participation in the reduced iron supply chain project with Emirates Steel.

Manufacturing cost will increase due to converting from blast furnace process to electric arc furnace process

Short term (2024) Medium term (2030) Long term (2050)

Converting from the blast furnace process to an electric arc furnace requires a lot of electricity. In addition to the electricity needed to melt the cold iron source in the electric furnace, more will be needed to make up for the heat from the by-product gas of the blast furnace, which currently is the main source of heat for the reheat furnaces and other processes in the steelworks. Consequently, we need a power infrastructure that can stably provide a large amount of electricity at competitive prices. We are actively making recommendations to policymakers with the aim of meeting these needs.

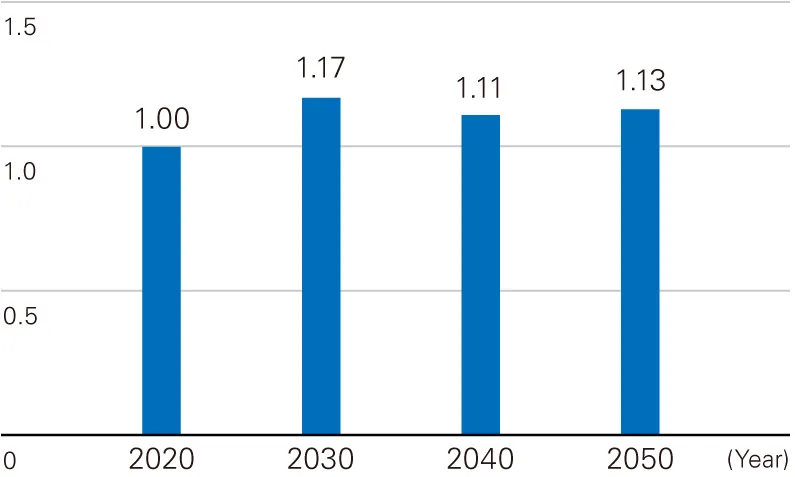

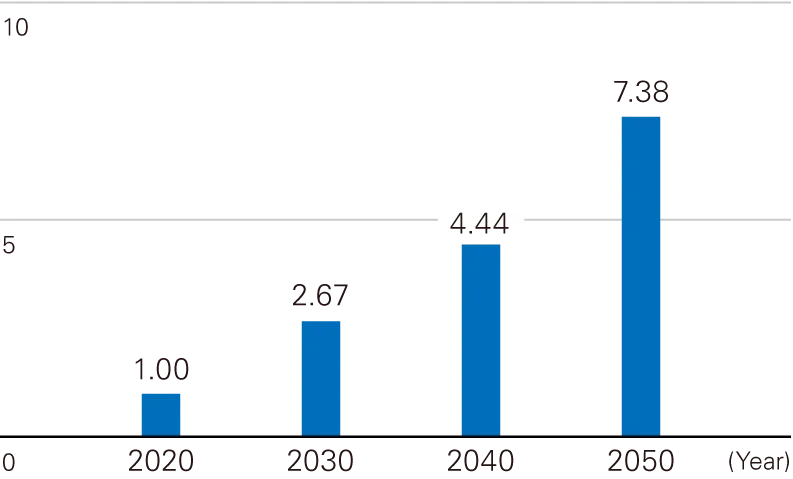

FOCUS Key Factor (3) Change in Demand for Automotive Steel

Changes in the product mix due to EV production and other factors

Short term (2024) Medium term (2030) Long term (2050)

As electric vehicles become more widely adopted, we expect to see changes in the types of steel materials required for automobiles. Demand for electrical steel sheets used in EV motors is rapidly expanding, and we expect changes in the product mix of steel materials, such as materials to offset the increased weight of batteries and stronger frames to protect them. The JFE Group has decided to take advantage of this trend by strengthening our production capacity for electrical steel sheets, and we are currently tripling production capacity for non-oriented electrical steel sheets at the Kurashiki district of the West Japan Works. In addition, JFE Steel has developed a cold-rolled steel sheet boasting 1.5 GPa-grade tensile strength as an eco-product and has put it into practical use as an automotive steel sheet. Furthermore, it has developed a multi-material structure that uses a small amount of fiber resin to maximize steel quality. In this new structure, a highly ductile, strong adhesive resin is sandwiched between a body part made of an ultra-high strength steel plate and a part made of a thin steel plate. This structure is capable of further reducing the weight of automobile frame parts and also improving collision safety performance. We will continue developing and proposing various products and technologies that meet customer needs.

In the meantime, aluminum and carbon fiber reinforced plastic are potential alternative materials for reducing the weight of cars. It has been pointed out, however, that the production cost of these materials and the amount of CO2 emitted throughout their life cycles is higher than those of steel. Therefore, under the 2℃ scenario, which assumes the introduction of a carbon pricing whereby the price differential between steel and alternative materials will be larger. Under this scenario, while the trend of using multi-materials may show some progress for luxury cars, their use would be limited for economy cars. Moreover, considering a situation in which all panels used for doors and other parts of a luxury car were changed to aluminum, the effect on weight reduction could be expected to be 5% of all materials used in luxury and economy cars together.

Estimated World Demand for Automotive Special Steel

Estimated World Demand for Automotive Electrical Steel Sheets

- Vertical axis:Steel demand (comparison by year with the year 2020 as 1.00)

- Source:Estimated by JFE Holdings based on the reports from METI’s Strategic Commission for the New Era of Automobiles

FOCUS Key Factor (4) Increase in Demand for Solutions to Enhance Decarbonization

Increase in demand for decarbonization solution businesses

Renewable Energy Power Generation Short term (2024) Medium term (2030) Long term (2050)

Demand for power generation plants using non-carbon emitting renewable energies is expected to increase. The JFE Group engages in designing, procuring, constructing, and operating biomass power generation*1, geothermal power generation*2, solar power generation*3, and onshore wind power generation plants in its engineering domain.

We will also focus on offshore wind power generation, which the Japanese government has positioned as one pillar of its Green Growth Strategy to achieve carbon neutrality by 2050. Specifically, we plan to manufacture and market monopiles and other seabed-fixed structures with JFE Engineering as the main driver. JFE Engineering has completed the construction of a monopile manufacturing plant, where operations commenced in April 2024*4. JFE Steel will contribute by increasing the supply of large and heavy steel plates, and JFE Shoji will assist by establishing SCM, which includes information sharing with Taiwan, a leader in offshore wind power generation, and East and Southeast Asian countries, where demand is expected to expand. We will also focus on O&M*5 to fully deploy Group resources.

Furthermore, from the perspectives of the effective use and recycling of resources, we are taking action to increase power output at waste processing facilities. JFE Engineering is developing a fully automated operation*6 to facilitate higher power output at waste incinerators (introduced to 12 facilities by FY2023, and will be gradually expanded to 16 facilities).

Moreover, we are utilizing renewable energy as the main power source for our retail electricity business*7, and in helping to establish and operate regional electricity retail companies*8, we focus on local production and consumption of electricity based on renewable energy. By FY2023, we have helped 8 locations establish and operate their regional electricity companies. In FY2024, we plan to do the same for 1 location, and in FY2030 for around 15 locations.

(Contribution to CO2 reduction resulting from renewable energy power generation/recycling/etc.: FY2020: 9.65 million tonnes per year → FY2024: 12 million tonnes per year → FY2030: 20 million tonnes per year)

- *1The JFE Engineering Corporation’s biomass power generation (Japanese only)

- *2The JFE Engineering Corporation’s geothermal power generation plant

- *3The JFE Engineering’s solar power generation (Japanese only)

The JFE Technos Corporation’s solar power generation (Japanese only) - *4Completion of Japan’s first manufacturing base of fixed-bottom foundation (monopile) for offshore wind turbines

- *5Operation and maintenance business

- *6JFE Engineering’s BRA-ING Pre-release (Japanese only)

- *7Urban Energy Corporation’s electricity retail business (Japanese only)

- *8Urban Energy Corporation’s regional electric power support business, targeting local governments (Japanese only)

Establishing regional electricity retail companies in partnership with local municipal governments (CSR Report 2022, P. 116)

Multisite Energy Total Service Short term (2024) Medium term (2030) Long term (2050)

In addition to the conventional service of optimizing energy use for single sites, JFE Engineering offers the Multisite Energy Total Service (JFE-METS)*, which optimizes energy use for multiple sites through centralized management. We realize overall energy savings and CO2 reduction by analyzing energy consumption at multiple sites and achieving total optimization by installing and operating energy-related equipment at each site to circulate energy throughout the network, including remote locations.

Recycling Business Short term (2024) Medium term (2030) Long term (2050)

We are striving to reduce the use of new fossil fuel-derived materials by recycling waste plastic and food waste. In waste plastic recycling, in addition to the conventional recycling of plastic containers and packaging, we are actively engaged in the so-called bottle-to-bottle business, in which used PET bottles are recycled into new ones. We have completed the construction of the PET bottle recycling raw material manufacturing plant (West Japan PET Bottle MR center), and full-scale commercial operations have begun. The plant recycles approximately 10% of the total number of PET bottles shipped nationwide, demonstrating a complete resource recycling model for reducing CO2 emissions. In food recycling, we generate methane gas from disposed food wastes to create renewable energy (fuel gas and electricity). JFE Engineering manages the engineering, procurement, and construction of recycling plants, while J&T Recycling Corporation manages the operation and business development of the plants*.

Industry-wide decarbonization cannot be achieved through technical developments in manufacturing alone. We therefore believe that demand for CCU and CCS facilities will increase as they facilitate the efficient use and storage of CO2. JFE Engineering is able to undertake the entire process of building CCU and CCS facilities from design and procurement to construction.

Solution Business for Low-Carbon Steelmaking Technologies Short term (2024) Medium term (2030) Long term (2050)

From the perspective of the steel industry, there is room for disseminating eco solutions (energy-saving steel technologies) in nations such as China, where close to 50% of the world’s crude steel is produced, and India and ASEAN countries, where further growth in production is expected. The potential CO2 reduction achieved by internationally transferring and disseminating advanced energy-saving technologies widely used in Japan will exceed 400 million t-CO2 worldwide (Japan is estimated to contribute to the reduction of approximately 80 million t-CO2 in FY2030 through these technologies). JFE Steel launched a solutions-business brand, JFE Resolus™, to provide solutions to a wide range of customers, including those outside the steel industry, based on manufacturing and operation technologies that JFE Steel has cultivated over many years in its steelmaking operations. Going forward, as the business environment and markets continue to undergo drastic change, JFE Steel will steadily enhance its proprietary technologies and, now under the JFE Resolus™ brand, offer customers the JFE Group’s advanced technologies and know-how as solutions for mutual growth and development.

FOCUS Key Factor (5) Unstable Raw Material Procurement due to Increased Occurrence of Climatic Hazards

Unstable material procurement

Short term (2024) Medium term (2030) Long term (2050)

In Australia, our major source country for raw materials, the frequency of typhoons is predicted to double. If production and shipments are disrupted in Australia for too long, there is no avoiding the impact on production, and depending on the situation, there is a risk that sales of steel materials will be impacted by a depletion of raw material stocks. To address this, we are promoting alternative procurement and dispersed supplier bases, stockpiling, and acquisition of raw material rights.

Alternative procurement, dispersed supplier bases, and stockpiling

Respond to disaster by carrying out spot procurement from China’s port stocks, increasing procurement from closer source countries such as Indonesia and front-loading the purchase and/or increasing the purchase contract of different brands from outposts in unaffected regions of Australia. Also, use the stock and external yard of the Group company Philippine Sinter Corporation.

The decarbonization in the steelmaking process is expected to lead to a diversification of the required raw materials. We will take into account the risk of climate change for these materials as well and work to establish diversified procurement sources.

FOCUS Key Factor (6) Damage to Production Bases and Offices Caused by Climatic Hazards

Damage to manufacturing bases from typhoons, heavy rain, and drought

Short term (2024) Medium term (2030) Long term (2050)

We are taking action to minimize damage under the assumption that typhoons and heavy rains will become stronger and that the occurrence of disasters comparable to the torrential rain in western Japan in 2018 will rise. We have currently invested approximately 6.5 billion yen for disaster prevention at steelworks and strengthened drainage facilities and other assets. About 3.5 billion yen of separate investment has already been made to prepare for water shortages at steelworks by installing desalination facilities at some of them. Although no severe drought disaster has struck since 1994, we are preparing to minimize any damage, even if the frequency of occurrence should increase.

All steelworks are exposed to the risk of floods associated with rising sea levels because of their location in coastal areas. The estimated sea level rise by 2050 is 20 to 30 cm (70 cm by 2100 if the impact of climate change manifests itself at the highest level). We believe that current measures against storm surge, which generates more sea level rise, are sufficient to address the risk. However, we will continue analyzing climatic hazards going forward to prepare for the changing circumstances.

FOCUS Key Factor (7) National Resilience

Strengthened infrastructure and disaster measures

Short term (2024) Medium term (2030) Long term (2050)

The JFE Group takes seriously the increased frequency and severity of recent climatic hazards in Japan and overseas. Having one’s daily life put in danger is a huge risk. It is our mission to promote disaster prevention and mitigation as well as national resilience to maintain vital infrastructure that is essential to daily life and economic activities.

Drawing upon its collective strengths, the JFE Group is able to contribute in many ways, such as by protecting key structures from earthquakes using structural steel such as high-strength H-shaped steel and steel pipe piles as well as steel sheet piles, reinforcing embankments that are prone to bursting, and providing disaster prevention products such as hybrid tide embankments and permeable steel slit dams. JFE Engineering is also able to handle a wide range of infrastructure construction projects, including bridges, gas, water and sewage, and pipelines.

Links to information about the JFE Group Environmental Vision for 2050 and Climate Change Scenario Analysis

- Commitment to a Low Carbon Society: Policy Engagement

- Targets and Results Related to Climate Change: Material Issues of Corporate Management and KPIs

- Initiatives on Climate Change: Initiatives to Address Climate Change Issues

- Technologies and Products Related to Reducing: Development and Provision of Eco-friendly Processes and Products