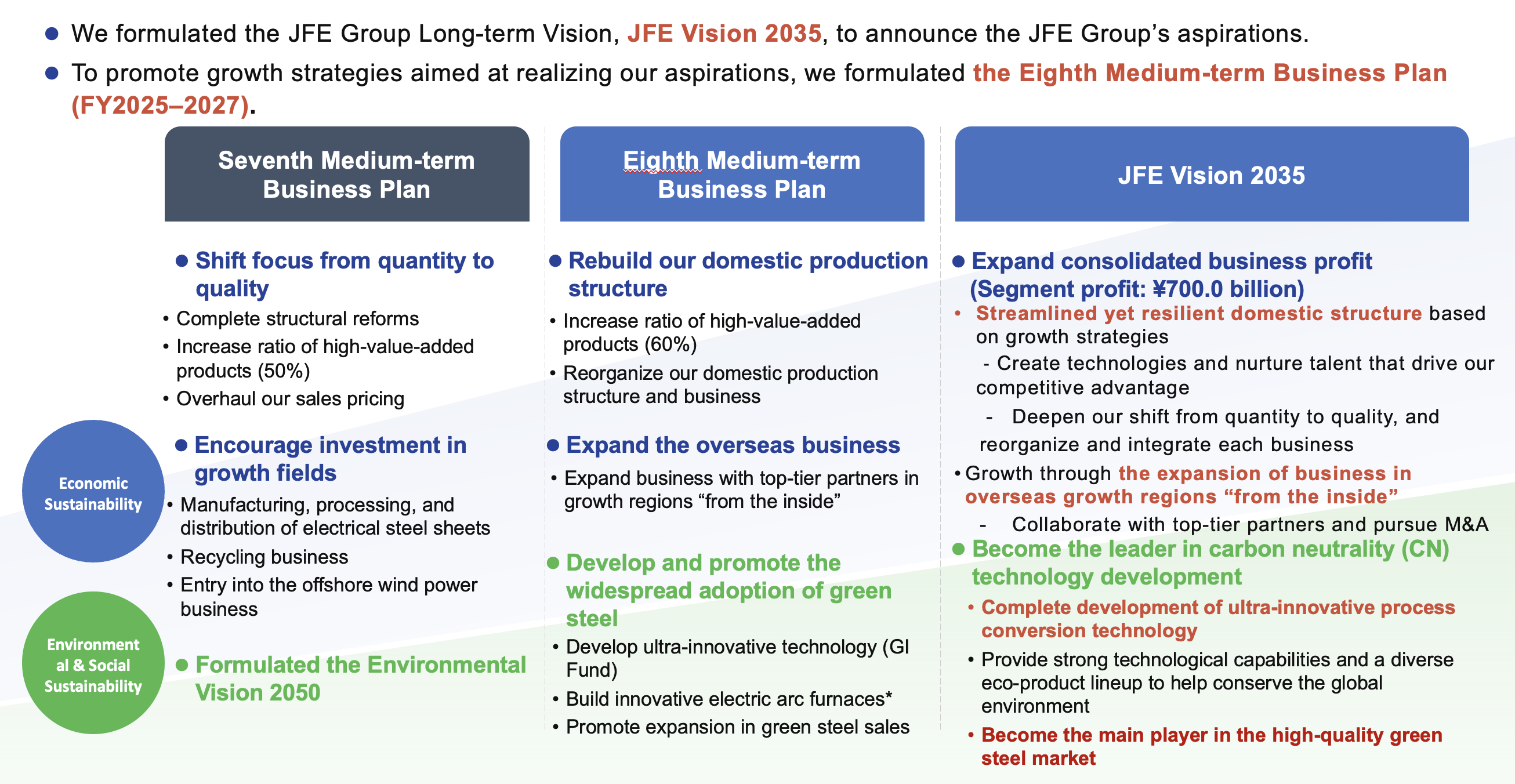

JFE Group Long-term Vision “JFE Vision 2035” and Eighth Medium-Term Business Plan

The JFE Group implemented its Seventh Medium-Term Business Plan (FY2021−FY2024) by pledging to take on the challenges of the most transformative period in the Group’s history to ensure a prosperous future for the planet. We tackled climate change as a top-priority business issue and achieved a milestone 18% reduction in greenhouse gas emissions in our steel business in fiscal 2024, compared to levels in fiscal 2013. We continue to make steady progress toward meeting our fiscal 2030 target of reducing emissions by at least 30% over fiscal 2013 by taking actions such as introducing innovative electric arc furnaces, scheduled to come online in fiscal 2028. Meanwhile, due primarily to the unexpectedly steep decline in the business environment for steel, consolidated business profit for fiscal 2024 was 135.3 billion yen, falling far short of the 320 billion yen target of the Medium-Term Business Plan.

Under these circumstances, we believe that two of the greatest concerns stakeholders have with regard to the JFE Group are: (1) its economic outlook, or whether it can achieve sustainable growth as competition intensifies across all fronts; and (2) its response to carbon neutrality, or whether it can meet the technological and financial challenges for achieving carbon neutrality. To address these two issues, we formulated our long-term JFE Vision 2035, targeting the year 2035 to present our aspirations and strategies.

JFE Group’s Aspirations

Our Corporate Purpose

In considering the JFE Group’s vision, we reexamined how each business should leverage its strengths to fulfill its role and contribute to society. And through extensive participation and discussion by employees in operating companies, we defined our corporate purpose as follows.

JFE Vision 2035—JFE Group’s Aspirations for 2035

Based on the JFE Group’s Corporate Vision and Standards of Business Conduct and the corporate purpose defined by each operating company, we defined the JFE Group aspiration as “becoming the leader in carbon neutrality (CN) technology development. ” We set the target of 700 billion yen in consolidated business profit as the level of profit necessary for developing technologies and making capital investments to achieve CN by 2050. We also formulated the Eighth Medium-Term Business Plan (FY2025−2027) to promote growth strategies for realizing the JFE Group’s aspirations in the face of a challenging business environment.

- *a large, high-efficiency electric arc furnace capable of producing high-grade and high-function steel products

Sustainability Initiatives of the Eighth Medium-Term Business Plan

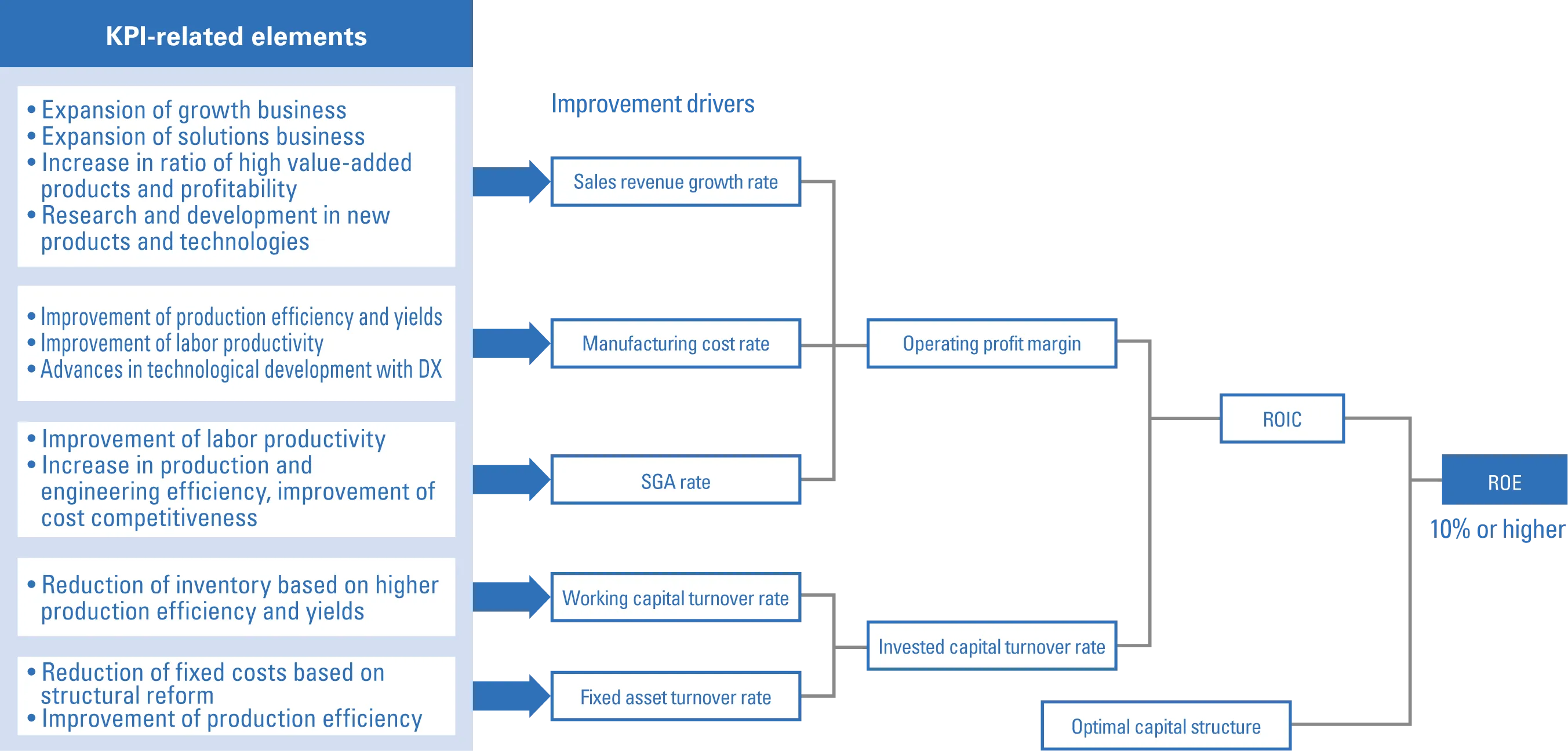

Following the formulation of our Eighth Medium-Term Business Plan, we reviewed our material issues of corporate management and KPIs. We extracted and scrutinized the necessary initiatives for the JFE Group to achieve sustainable growth by backcasting from our past initiatives on environmental and social issues and long-term vision and identified 16 material issues.

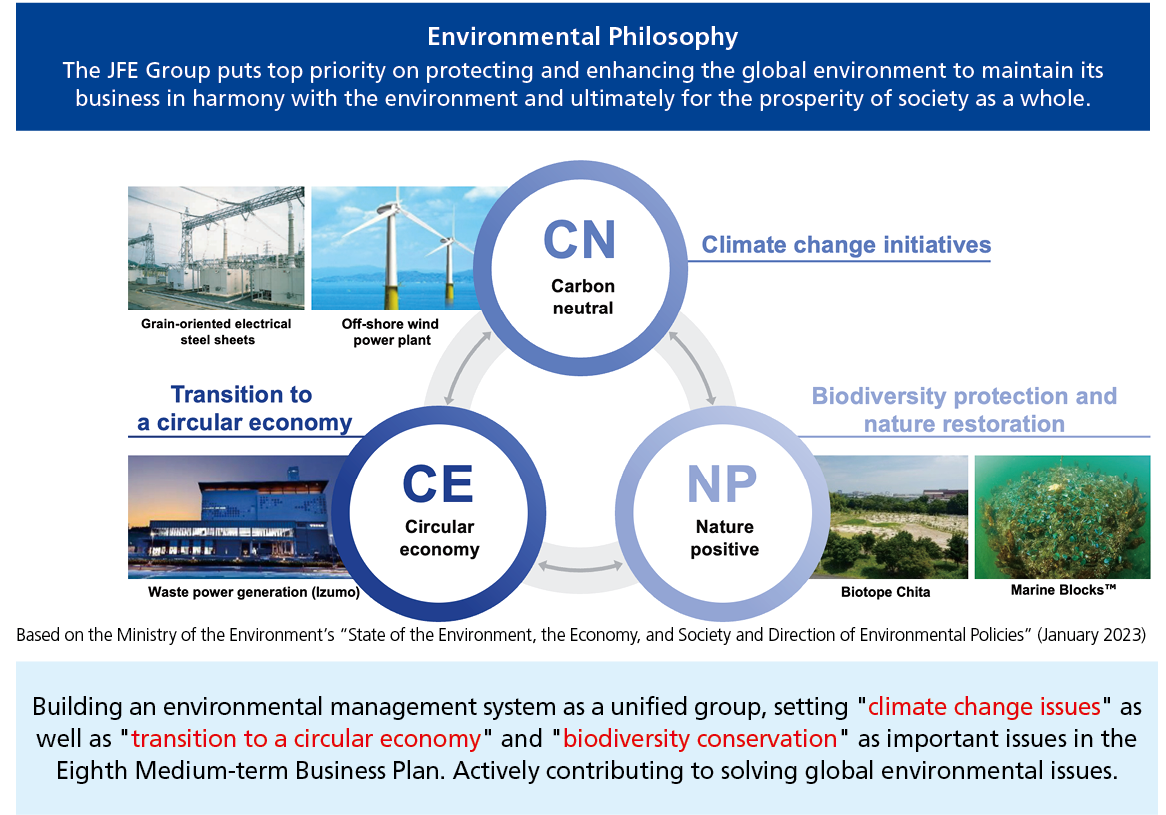

Initiatives to Achieve Environmental Sustainability

In addition to climate change, a top-priority business issue in the previous Medium-Term Business Plan, we will proactively strive Groupwide to drive the transition to a circular economy and engage in biodiversity conservation and nature positive.

Initiatives to Address Climate Change Issues

We will further promote initiatives for achieving carbon neutrality by 2050, guided by the JFE Group Environmental Vision for 2050 formulated in 2021. In the steel business, we will position the current Medium-Term Business Plan period as a preparatory phase toward achieving the fiscal 2030 target of reducing GHG emissions by at least 30% compared to levels in fiscal 2013 and completing as scheduled the development of ultra-innovative technologies in fiscal 2035. Accordingly, we will continue working to roll out the innovative electric arc furnace in the Kurashiki district of the West Japan Works in Okayama Prefecture and develop ultra-innovative technologies. In the engineering business, we will work to achieve the fiscal 2030 target of reducing GHG emissions across society by 20 million tons by capturing the demand for offshore wind power while also seeking to win EPC* orders and participate in projects in the hydrogen, ammonia, and carbon capture and storage areas, where social implementation is expected to advance in the years ahead.

- *Projects in which the engineering, procurement, and construction processes are undertaken as a single package.

Initiatives to Realize a Circular Economy

The JFE Group is focusing on the priority issues of expanded use and sales of recycled materials, development of resource-efficient eco-products and eco-solution technologies, and conversion of byproducts and waste into resources, and it will promote initiatives that leverage the strengths of each operating company and Group synergies.

Initiatives to Promote Biodiversity Conservation and Nature Positive

By deepening our awareness that the JFE Group’s business activities depend on and impact biodiversity and natural capital, we will promote initiatives to mitigate the associated risks. At the same time, we will not only develop processes, products, and technologies that contribute to these initiatives but also advance activities through diverse approaches, including collaborating with local communities and the supply chain. The JFE Group also endorses the TNFD* recommendations and will disclose information in line with the TNFD framework to share information with society at large.

- *Taskforce on Nature-related Financial Disclosure

Promoting Our Human Resources Strategy and Human Capital Management

The JFE Group believes that human resources are the driving force for corporate growth in times of transformation. In executing and realizing our management strategies, we formulated our human resources strategy from a long-term perspective with the understanding that the Company’s sustainable growth must be actively linked with the personal growth of employees. This strategy focuses on securing skilled resources to build our talent portfolio, advancing DEI to maximize individual capabilities, and enhancing work engagement.

Corporate Governance

We transitioned to being a company with an Audit & Supervisory Committee with the aim of swiftly responding to rapid and major changes in the environment surrounding the Company, such as carbon neutrality and DX. We will further advance initiatives undertaken in the previous Medium-Term Business Plan for enhancing the effectiveness of the Board of Directors and strengthening its supervisory functions. By doing so, we will strive to accelerate management decision-making, enrich Board member discussions on management policies and strategies, and further strengthen the Board’s supervisory role. We will also introduce new indicators to calculate ESG remuneration for directors.

Major Performance and Profitability Targets, Shareholder Returns Policy

Major performance and profitability targets for the current Medium-Term Business Plan are listed below. We consider returning profit to shareholders as one of the top management priorities. We will proactively distribute dividends while striving to ensure the entire Group’s sustainable corporate structure. While we intend to maintain a dividend payout ratio of around 30%, our policy is to set a minimum of 80 yen per share from the perspective of conducting stable dividends.

| Eighth Medium-Term Business Plan FY2027 |

|||

|---|---|---|---|

| JFE Group | Consolidated business profit | 400.0 billion yen | |

| ROE | 10% or more | ||

| Debt/EBITDA | About 3 times | ||

| D/E | About 60% | ||

| Operating Companies | Steel business | Segment profit | 260.0 billion yen |

| Engineering business | Segment profit | 42.0 billion yen | |

| Trading business | Segment profit | 60.0 billion yen | |

| Shareholder Returns | Dividend Policy | Payout ratio of around 30% with minimum set at 80 yen per share | |

For measures of each operating company, refer to JFE GROUP REPORT 2025 (Integrated Report)