Scenario Analysis in Line with the TCFD Recommendations

Initiatives

The JFE Group intends to achieve carbon neutrality by 2050, and it leverages the scenario analysis in line with the TCFD recommendations to identify and assess climate change-related risks and opportunities and to strengthen the resilience of its organizational strategy. Please refer to the Initiatives to Address Climate Change Issues page for governance, strategy, risk management, metrics, and targets for climate change-related issues in line with the TCFD recommendations.

Timeline of Milestones Related to Climate Change Developments and JFE’s Key Initiatives

| 1997 | Kyoto Protocol adopted at COP3 in Kyoto |

|---|---|

| 2008 | JISF’s Voluntary Action Plan launched |

| 2013 | JISF’s Commitment to a Low Carbon Society launched |

| 2015 | Paris Agreement adopted at COP21 |

| 2017 | TCFD published the final report of its recommendations |

| 2018 | JISF announced the Long-term Vision for Climate Change Mitigation, Zero Carbon Steel |

| 2019 | JFE Group announced its endorsement for the final report of the TCFD recommendations JFE Group published a scenario analysis in line with the TCFD recommendations |

| 2020 | Keidanren launched the Challenge Zero initiative Ministry of Economy, Trade and Industry published a list entitled Companies Taking on the Zero-Emission Challenge JFE Group published its targets in its medium- to long-term vision (target for 2030 and achieving carbon neutrality by 2050) Prime Minister Suga declared Japan will achieve carbon neutrality by 2050 |

| 2021 | JISF announced the Basic Policy of the Japan Steel Industry on 2050 Carbon Neutrality Aimed by the Japanese Government JFE Group published its roadmap for achieving carbon neutrality in 2050 in the JFE Group Environmental Vision for 2050 Japanese government formulated the Green Growth Strategy Through Achieving Carbon Neutrality in 2050 |

| 2022 | JFE Group announced that the CO2 emissions reduction target for FY2030 for JFE Steel has been revised upward to 30% or more compared to FY2013 JISF published the “Evaluation of the Phase I Target (FY2020 Target)” and Phase II (FY2030 target) of reducing the total volume of energy-related CO2 emissions by 30% in its “Activities to Combat Global Warming—Report of JISF’s Carbon Neutrality Action Plan (Commitment to a Low Carbon Society) (March 2022)” |

| 2023 | The Act Concerning the Promotion of a Smooth Transition to a Decarbonized Economic Structure (GX Promotion Act) was enacted |

| 2025 | Japanese government published GX2040 Vision JFE Group announced its long-term vision JFE Vision 2035 and the Eighth Medium-term Business Plan (FY2025-FY2027) |

The Challenge Zero (Innovation Challenges Toward a Net Zero Carbon Society) is a new joint initiative by Keidanren (Japan Business Federation) and the Japanese government for proactively publicizing and supporting companies and organizations that pursue innovative actions toward realizing a decarbonized society as the long-term goal of the Paris Agreement.

The JFE Group endorses the Challenge Zero declaration and will rise to the challenge of pursuing innovation.

The Ministry of Economy, Trade and Industry (METI), in collaboration with Keidanren and the New Energy and Industrial Technology Development Organization (NEDO), has been tackling a project called the Zero-Emission Challenge. The project is preparing a list of companies generating innovation toward realizing a decarbonized society and providing investors and other stakeholders with useful information on them. The JFE Group was designated as one of approximately 600 listed and unlisted companies in the Zero-Emission Challenge, announced at the TCFD Summit 2021 as part of Japan’s efforts toward achieving a decarbonized society.

The JFE Group publishes information on specific initiatives through the following website.

Scenario Analysis

Tools and Methods

Scenario analysis is used to portray an accurate understanding of climate-related risks and opportunities and assess implications to the current business strategy, thereby enabling an organization to establish strategies that reflect the results of the assessment. As our business could be significantly affected by climate change, we have created both a 1.5°C scenario and a 4°C scenario. In setting the 1.5°C scenario, we also took into account the 2°C / below 2°C scenarios*1.

All scenarios are based on those developed by the International Energy Agency (IEA). Analysis was conducted under the assumption that major emitting countries implement uniform carbon pricing to increase the feasibility of achieving the 1.5°C target.

Our goal under the long-term scenario analysis is to achieve carbon neutrality by 2050. We conducted risk assessments that take into account the 1.5°C scenario (IPCC 1.5°C Special Report) in steelmaking and the necessity of ultra-innovative technology to achieve the Shared Socioeconomic Pathways (SSP) for carbon neutrality by 2050.

| Selected Scenario | 1.5℃ Scenario | 4℃ Scenario | |

|---|---|---|---|

| Reference Scenario | Transition Risks |

Transition scenarios developed by the IEA

|

Transition scenarios developed by the IEA

|

| Physical Risk |

Climate change projection scenario developed by the Intergovernmental Panel on Climate Change (IPCC)

|

||

| How Society will Look |

Dynamic policies will be adopted and technical innovations will progress to limit the average temperature rise by the end of this century to 1.5°C and realize sustainable development.

|

Despite new policies implemented in each country based on approaches under the Paris Agreement, the average temperature will rise by about 4°C by the end of this century.

|

|

- *1The Sustainable Development Scenario (SDS) and the 2°C Scenario (2DS) are used for the 2°C / below 2°C scenarios.

- *2Source: IEA’s Net Zero by 2050 — A Roadmap for the Global Energy Sector

- *3Source: IEA’s World Energy Outlook 2024

- *4Source: IEA’s Energy Technology Perspectives 2017

- *5Source: IPCC Fifth Assessment Report

- *6Source: IPCC Sixth Assessment Report

- *7When carbon pricing varies by country, a gap opens in international competitiveness between industries in countries with strict CO2 regulations and those in countries with less strict regulations. This results in carbon leakage, where production and investment shrink in stricter countries (reducing CO2 emissions) while expanding in more lenient countries (increasing CO2 emissions). Accordingly, it is assumed that carbon pricing will be introduced in developed countries and some developing countries.

Scope of Business and Period for Analysis

This analysis covers the following businesses: the steel business by JFE Steel, the engineering business by JFE Engineering, the trading business by JFE Shoji, and businesses carried out by some of the other Group companies. The period covered is up to 2050.

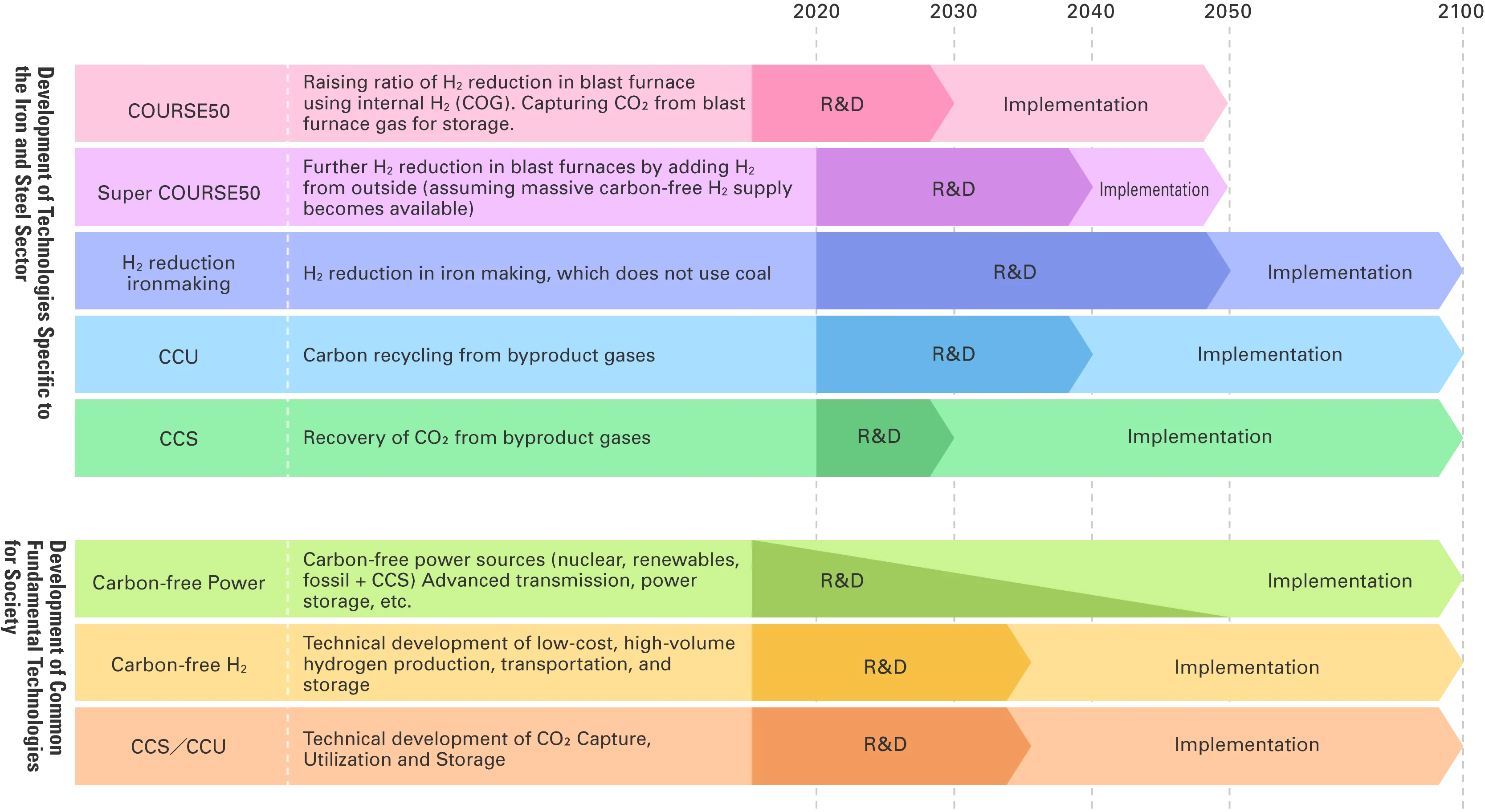

Relevance with the JISF’s Long-term Vision for Climate Change Mitigation

The Japan Iron and Steel Federation (JISF) has been working toward its Commitment to a Low Carbon Society, and Phase I of this initiative ended in FY2020. From FY2021, the effort was rebranded as the Carbon Neutrality Action Plan, and the Phase II target (FY2030 target) was revised. In November 2018, the JISF also formulated and published the Long-term Vision for Climate Change Mitigation for 2030 and beyond. JFE Steel played a central role in the formulation of this long-term vision. The vision represents the industry’s challenge toward realizing zero-carbon steel and lays out the prospect of achieving the 2°C scenario for steelmaking and necessity of ultra-innovative technologies to achieve the 1.5°C scenario. Furthermore, on February 15, 2021, the JISF announced the “Basic Policy of the Japan Steel Industry on 2050 Carbon Neutrality Aimed by the Japanese Government,” which declares that the Japanese iron and steel industry will boldly accept the challenge of realizing zero-carbon steel.

The JFE Group’s scenario analysis is intended to ensure resiliency in our Group’s business strategy during the intermediate stages of these long-term challenges.

Efforts to Achieve Zero Carbon Steel

Process to Identify Key Factors that Impact the Business

| STEP 1: | Examine the entire value chain from a holistic perspective and sort out factors that impact the businesses under analysis (for more information on risks and opportunities in the value chain, please refer to: JFE Group Value Chain) |

|---|---|

| STEP 2: | Examine all factors at an overview level and identify key factors by taking into account the level of impact and stakeholder expectations and concerns |

| 1.5℃Scenario | 4℃Scenario | |

|---|---|---|

| Impact on Procurement |

|

|

| Impact on Direct Operation |

|

|

| Impact on Product and Service Demand |

|

|

| Axis for identifying key factors: | • Level of impact (possibility of risks and opportunities arising × Level of impact if manifested) |

|---|---|

| • Expectations and concerns of stakeholders |

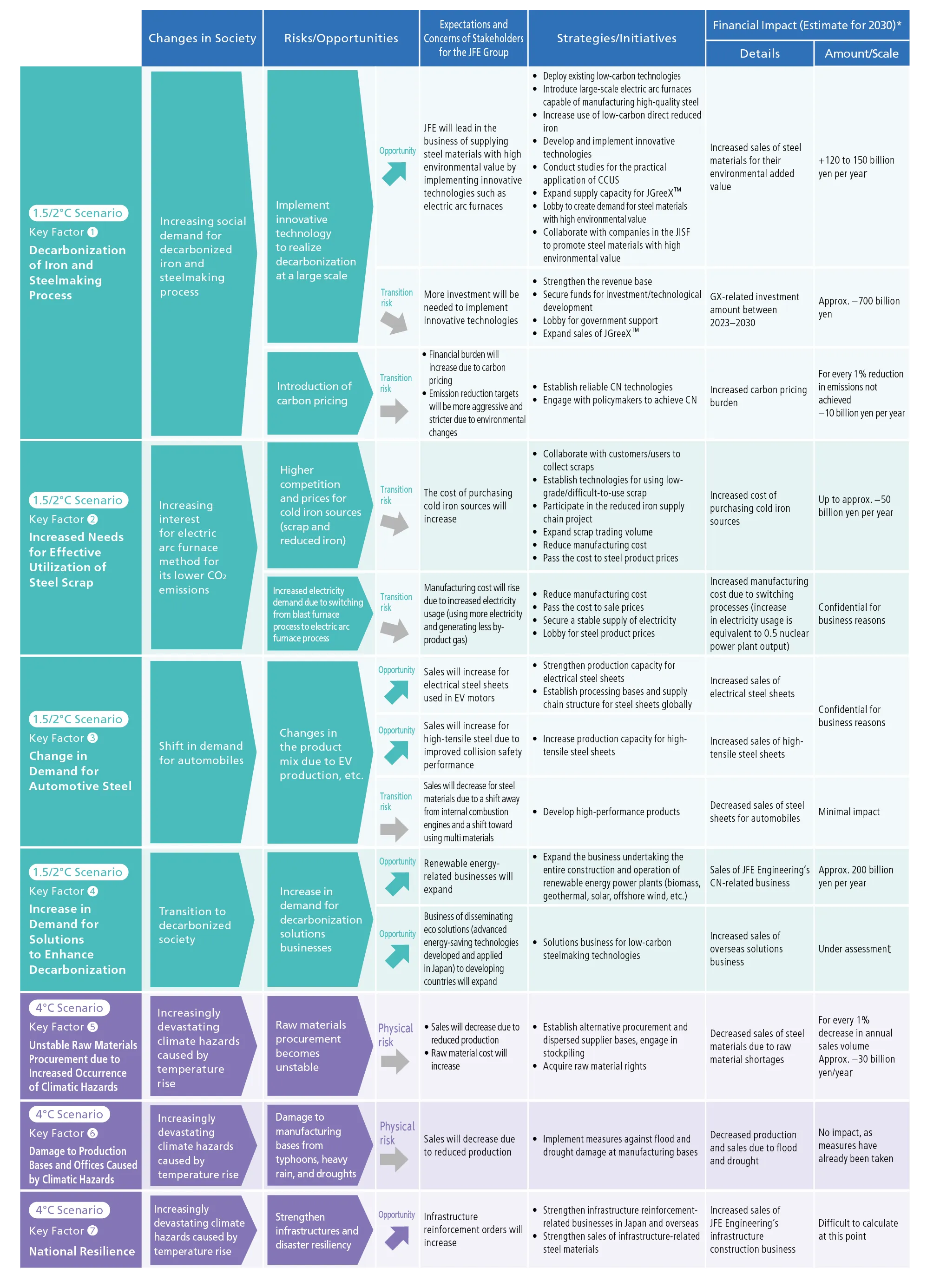

Results of Scenario Analysis

Climate change is a critical business concern for the JFE Group from the perspective of business continuity. Our steel business, which emits 99.9% of the Group’s total CO2 emissions, has been developing and applying energy-saving and CO2 emissions reduction technologies to the steelmaking process to address decarbonization risks. At the same time, given rising demand for effective use of steel scrap, we are working to convert the steelmaking process from blast furnaces to electric arc furnaces and secure cold iron sources. Going forward, we will continue to develop processes to further reduce environmental impact, and by globally deploying our diverse technologies, we will view climate change as an opportunity and contribute to addressing related issues.

The JFE Group has developed and maintains a variety of eco-friendly products and technologies, including high-performance steel materials that contribute to energy savings when uses by customers, as well as renewable energy power generation, thereby responding to the growing demand for decarbonization solutions. Going forward, with automobiles expected to become increasingly lighter and more electrified, we will further enhance the performance of JFE’s high tensile strength steel sheets and electrical steel sheets to meet the changing demand for automotive steel and contribute to the realization of a low-carbon society.

It is also important to prepare for physical risks such as unstable raw material procurement due to frequent meteorological disasters and the damage they cause. The JFE Group is strengthening its resilience to address these risks.

At the same time, we will continue to develop and disseminate the necessary technologies for achieving the long-term goal of the Paris Agreement of keeping the global average temperature increase well below 2°C compared to pre-industrial levels and limiting it to 1.5°C. We will also contribute to national resilience by supplying and constructing steel for social infrastructure in preparation for the anticipated intensification of meteorological disasters.

Analysis Results

- Note:Assessment results are estimated outcomes based on scenario analysis and do not represent actual performance.

Overview of Scenario Analysis Assessment and JFE Group’s Focus

Timeframe:short term (2027) ⇒ until 2027, medium term (2035) ⇒ until 2035, long term (2050) ⇒ until 2050 (final)

FOCUS Key Factor (1) Decarbonization of Iron and Steelmaking Process

Implementation of innovative technologies to realize large-scale decarbonization

Supply steel materials with high environmental value through implementation of innovative technologies such as electric arc furnaces Short term (2027) Medium term (2035)

JFE Steel has actively sought to improve efficiency and decarbonize the iron and steelmaking processes by developing energysaving technologies and has established process technologies boasting the world’s top energy efficiency. Taking advantage of the increasing public demand for decarbonized iron and steelmaking processes, we have the capacity to supply steel products with high environmental value, manufactured by deploying the low-carbon technologies we have developed across our steelworks.

The global drive toward decarbonization is intensifying, and with rising demand to reduce GHG emissions across entire supply chains, interest is rapidly growing for low-GHG emission steel products, particularly in industries such as automotive. In the IEA’s Net Zero by 2050 Scenario, the share of steel production using the electric arc furnace method is projected to increase to 37% by 2030 and 53% by 2050. Going forward, demand is expected to expand for steel products made with the electric arc furnace method, which emits fewer GHG emissions.

During this transition, JFE Steel will introduce innovative electric arc furnaces capable of producing high-performance, high-quality steel materials that could previously only be manufactured using the blast furnace process. In addition, we will cut overall GHG emissions from the steelmaking process by using direct reduced iron with low carbon emissions.

Since the first half of FY2023, we have been supplying JGreeX™, a brand of green steel products that significantly reduces GHG emissions in the steelmaking process compared to conventional products. Since it is not immediately possible to achieve zero GHG emissions, we allocate the reductions created by our emission-reduction technologies to selected steel products by applying the mass balance approach and supply them as steel products with environmental value. Going forward, we will contribute to the decarbonization of society by expanding our capacity to supply JGreeX™. To broaden public recognition of these efforts, we are actively lobbying to stimulate demand for steel products with environmental value, while promoting adoption in collaboration with other JIFS member companies.

Long term (2050)

Over the long term, to achieve carbon neutrality by 2050, as stated in the JFE Group Environmental Vision for 2050, we are pursuing the development of carbon-recycling blast furnaces (CR blast furnaces), utilization of hydrogen through the direct hydrogen reduction method, and manufacturing methods for high-quality steel using the electric arc furnace method. In particular, the technology that combines a CR blast furnace with CCU is an ultra-innovative technology for achieving net zero CO2 emissions by drastically reducing CO2 emissions from the blast furnace process, enabling efficient mass production of high-grade steel and allowing the reuse of CO2 in the blast furnace. As for the CO2 that cannot be fully reused in the blast furnace, we are also studying the practical application of carbon capture, utilization, and storage (CCUS) technologies to pursue further reduction potential.

More investment needed to implement innovative technologies Short term (2027) Medium term (2035)

The introduction of electric arc furnaces and ultra-innovative technologies carries the risk of increased investment burden to achieve carbon neutrality. At JFE Steel, decisions on the necessary capital investments to achieve the FY2030 GHG reduction target are nearly complete, with about 0.4 trillion yen in GHG reduction investments decided between FY2021 and FY2024. In addition, we estimate that about 0.6 trillion yen of investments will be required by 2035.

Sustaining these large-scale investments will require that we strengthen our revenue base and secure funds for investment and technology development. JFE Steel is promoting research and development using external funds such as the Green Innovation Fund while also lobbying to obtain government support.

In addition, through the expanded sales of JGreeX™, a green steel product that significantly reduces GHG emissions, we will encourage the market penetration of environmentally valuable products and achieve profitability while protecting the environment. With these initiatives, we will pursue sustainable growth toward realizing a decarbonized society and securing long-term competitiveness.

Long term (2050)

Although the measures to be taken under the 2°C and 1.5°C scenarios will not significantly differ, we must consider scale and scope. In the case of the 1.5°C scenario, it will be necessary to further accelerate the development and implementation of decarbonization technologies, which will require even greater research and development and capital investment expenditures. In addition, the development of infrastructure to stably supply inexpensive, abundant green hydrogen and electric power will be a prerequisite. In addressing these issues, it will be necessary for society as a whole to consider how to share the costs and for the government to formulate long-term strategies for the supply of green hydrogen and electric power, in collaboration with society.

Financial burden will increase due to carbon pricing, and emission reductions targets will be more aggressive and stricter due to environmental changes

Short term (2027) Medium term (2035) Long term (2050)

Various carbon pricing systems are being introduced around the world, and in Japan an emissions trading system (GX-ETS) based on the GX Promotion Act is scheduled to be fully introduced starting in FY2026 to help achieve the global goal of carbon neutrality by 2050. In Europe, discussions are progressing on the Carbon Border Adjustment Mechanism (CBAM); ahead of full implementation in 2026, a transitional period began on October 1, 2023, imposing reporting obligations on the relevant operators, and we are complying with this requirement.

Carbon pricing systems in Japan and overseas vary in unit price and the approach to taxable items, and there are currently many uncertainties. It will be necessary to appropriately anticipate impacts while monitoring future developments. On the other hand, such systems can also become important mechanisms for ensuring that steel products with environmental value are properly recognized and reflected in market pricing.

JFE Steel is proactively engaging in carbon neutrality, including making necessary recommendations to the government to ensure that the carbon pricing system is appropriately designed. In addition to its involvement in the design of such systems, the Company will continue research and development to establish reliable carbon neutrality technologies and reduce emissions grounded in technological evidence, enabling flexible and sustainable responses to changes in policy and the operating environment.

FOCUS Key Factor (2) Increased Need for Effective Utilization of Steel Scrap

Cost of purchasing cold iron sources (scrap/reduced iron) will increase

Short term (2027) Medium term (2035) Long term (2050)

The electric arc furnace method, which has low CO2 emissions, is attracting increasing global attention, and countries are introducing electric furnace facilities. At the JFE Group, in addition to maximizing the use of existing electric arc furnaces, we have decided to introduce an electric arc furnace at the East Japan Works (Chiba District) and an innovative electric arc furnace at the West Japan Works (Kurashiki District). Going forward, demand is expected to increase even further for cold iron sources such as scrap and direct reduced iron, raising concerns about the risk of higher costs for procuring the cold iron sources needed to maintain steel quality and ensure stable production. We are responding by strengthening collaboration with customers and users in scrap collection to ensure a stable supply of high-grade scrap. We are also advancing research and development to establish technologies for using low-grade and difficult-to-use scrap, to expand the amount of scrap handled and promoting the effective use of resources.

In addition, we are taking part in a Middle East direct reduced iron project to ensure stable procurement of direct reduced iron. Through these activities, we are reducing procurement risks for cold iron sources while lowering manufacturing costs.

Furthermore, based on the market evaluation of steel products with high environmental value, we are seeking to sustainably operate our business by appropriately passing these costs on to steel prices.

Power demand will increase due to converting from blast furnace process to electric arc furnace process

Short term (2027) Medium term (2035) Long term (2050)

Converting from blast furnaces to electric arc furnaces requires large amounts of electric power. In addition to the power needed to melt cold iron sources in electric arc furnaces, power will also be needed to make up for the heat sources previously supplied through byproduct gases generated in blast furnaces and other facilities, which had been used in reheating furnaces and elsewhere within steelworks. Since this increase in power demand involves the risk of higher manufacturing costs, we are working to reduce manufacturing costs at JFE Steel through more efficient processes and technological innovation. Furthermore, based on the market evaluation of steel products with high environmental value, we are seeking to sustainably operate our business by appropriately passing these costs on to sales prices. In addition, stable operation of the electric arc furnace process requires a large and stable supply of power at competitive prices. To this end, we are lobbying the government for stable power supply and pricing and recommending policies for institutional development and reinforcing infrastructure.

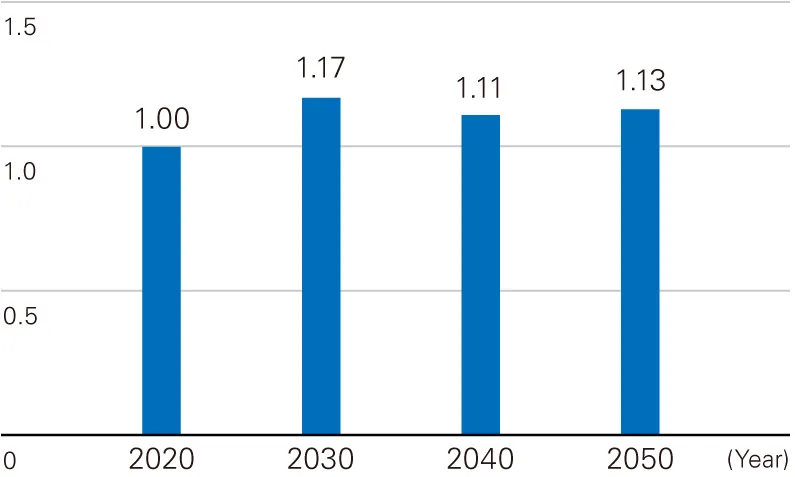

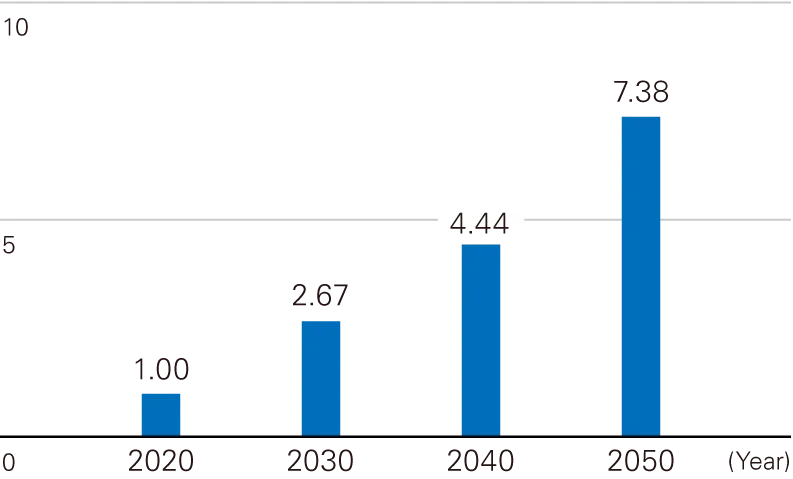

FOCUS Key Factor (3) Change in Demand for Automotive Steel

Changes in the product mix due to EV production and other factors

Sales volume of electrical steel sheets for EV motors will increase Short term (2027) Medium term (2035) Long term (2050)

The widening adoption of electric vehicles is expected to change the composition of steel demand. In addition to the expansion of demand for electrical steel sheets for motors, the product mix of steel is diversifying to encompass lighter-weight steel to offset the increase in weight from batteries and stronger frames to protect batteries. At the JFE Group, we view this change as an opportunity and are bolstering our ability to respond. First, as part of strengthening manufacturing capacity for electrical steel sheets, we are proceeding with construction to triple our production capacity of non-grain-oriented electrical steel sheets at the West Japan Works (Kurashiki District) compared to current levels. In addition, we are building a global processing and distribution system for electrical steel sheets to respond to the worldwide expansion of the EV market.

Sales volume of high-strength steel sheets will increase due to improved collision safety Short term (2027) Medium term (2035) Long term (2050)

To achieve both weight reduction and collision safety performance, we have decided to construct a new continuous hot-dip galvanizing line (CGL) at the West Japan Works (Fukuyama District) to expand production capacity for ultra-high-tensile-strength steel sheets. On the product development front, in addition to the commercialization of 1.5 GPa-grade cold-rolled steel sheets, we have developed a multi-material structure that maximizes the performance of steel by incorporating a small amount of resin. This structure sandwiches a highly ductile, strongly adhesive resin between a main component made of ultra-high strength steel and a thin steel plate component, thereby achieving further weight reduction and improved collision safety in automotive body frame components.

Steel sales volume will decrease due to material substitution in multi-materialization Short term (2027) Medium term (2035) Long term (2050)

Shifting to materials such as aluminum and carbon fiber reinforced plastics (CFRP) to reduce vehicle weight poses potential risk. These materials have higher manufacturing costs than steel and generate more CO2 emissions over their life cycle. In the 1.5°C scenario, which assumes the introduction of carbon pricing, the price gap between steel and these materials could further widen. As a result, while the use of multi-material designs is expected to progress to some extent in luxury vehicles, adoption by mass-market vehicles is likely to remain limited. Even if all panel components, such as the doors of luxury vehicles, were replaced with aluminum, the resulting weight reduction would affect only about 5% of the total body materials across both luxury and mass-market vehicles. Taking into account the anticipated increase in automobile production volume, the impact on steel demand for vehicle bodies is expected to remain limited.

Estimated World Demand for Automotive Special Steel

Estimated World Demand for Automotive Electrical Steel Sheets

- *Vertical axis:Steel demand (comparison by year with the year 2020 as 1.00)

- *Source:Estimated by JFE Holdings based on the reports from METI’s Strategic Commission for the New Era of Automobiles

FOCUS Key Factor (4) Increase in Demand for Solutions to Enhance Decarbonization

Increase in demand for decarbonization solution businesses

Expansion of renewable energy-related business Short term (2027) Medium term (2035) Long term (2050)

Demand is expected to continue rising for power generation plants using renewable energy that does not emit carbon. In the engineering business, we are expanding operations through the integrated provision of engineering, procurement, construction, and operation and maintenance (EPC and O&M*4) for renewable energy plants, including biomass power generation*1, geothermal power generation*2, solar power generation*3, and wind power generation.

The Japanese government has positioned offshore wind power generation as a pillar of its Green Growth Strategy for realizing carbon neutrality by 2050. In this context, efforts are being promoted on a Groupwide basis, led by JFE Engineering in the manufacture of seabed-fixed foundation structures such as monopiles. We also built Japan’s first monopile foundation manufacturing plant, which began operation in April 2024*5. The steel business supplies large, heavy plates, and the trading business develops supply chain management, including the provision of information on Taiwan and potential demand regions such as East and Southeast Asia.

In addition to renewable energy, we are focusing on developing and implementing carbon capture, utilization, and storage (CCUS) solutions, as well as commercializing green hydrogen and ammonia-related technologies. Strengthening these initiatives for next-generation technologies will accelerate the delivery of solutions for realizing a decarbonized society and open up business opportunities with high environmental value.

- *1The JFE Engineering Corporation’s biomass power generation (Japanese only)

- *2The JFE Engineering Corporation’s geothermal power generation plant

- *3The JFE Engineering’s solar power generation (Japanese only)

The JFE Technos Corporation’s solar power generation (Japanese only) - *4Engineering, procurement, and construction (EPC) and operation and maintenance (O&M) business

- *5Completion of Japan’s first manufacturing base of fixed-bottom foundation (monopile) for offshore wind turbines

Expansion of waste-to-resource-related business Short term (2027) Medium term (2035) Long term (2050)

From the perspective of resource circulation and effective use, efforts are also underway at waste treatment facilities to increase power generation from waste-derived sources. The engineering business is focusing on fully automated operation*6 of waste incinerators, which makes it possible to increase power generation. In addition, we are actively engaged in the electricity retail business*7, which uses renewable energy as the main power source, and supporting the establishment and operation of new regional electricity retail companies*8, focused on local production and consumption of energy using renewable energy.

JFE Engineering is going beyond conventional energy optimization site by site to develop a Multisite Energy Total Service (JFE-METS )*9 that optimizes energy by collectively managing multiple sites. This service achieves overall energy savings and reductions in CO2 by analyzing actual energy consumption at multiple sites, deploying and optimizing energy-related facilities at each site, and enabling energy interchange, including at remote sites.

- *6JFE Engineering’s BRA-ING Pre-release (Japanese only)

- *7Urban Energy Corporation’s electricity retail business (Japanese only)

- *8Urban Energy Corporation’s regional electric power support business, targeting local governments (Japanese only)

Establishing regional electricity retail companies in partnership with local municipal governments (CSR Report 2022, P. 116) - *9JFE Engineering’s “Multisite Energy Total Service (JFE-METS)” (Japanese only)

Expansion of low-carbon businesses (eco-solutions) Short term (2027) Medium term (2035) Long term (2050)

There is ample room in the steel industry for disseminating energy-saving steel technologies (eco-solutions) in countries such as China, which accounts for about 50% of global crude steel production, as well as in India and ASEAN countries, where further economic growth and expanded production are expected. Internationally transferring and deploying advanced energy-saving technologies already in use in Japan is expected to yield a potential reduction of more than 400 million tonnes of CO2 worldwide in FY2030, of which Japan’s contribution is projected to be approximately 80 million tonnes of CO2.

JFE Steel has launched JFE Resolus™, a solution business that applies the accumulated manufacturing and operational technologies from steelmaking to address issues faced by a wide range of industries beyond the steel industry. As the business environment and marketplace undergo significant change, we are further enhancing our own manufacturing technologies while providing the JFE Group’s technologies and know-how under the JFE Resolus™ brand, working in concert with customers to achieve sustainable growth.

FOCUS Key Factor (5) Unstable Raw Material Procurement due to Increased Occurrence of Climatic Hazards

Unstable material procurement

Short term (2027) Medium term (2035) Long term (2050)

JFE Steel is taking multiple precautions against the risk of instability in the procurement of steelmaking raw materials associated with climate change. In Australia, a source of our major raw materials, the frequency of typhoons is expected to double in the future, and our ability to supply steel products could be impacted if a suspension of production and shipping operations results in a depletion of our raw material inventories. To address this risk, we are strengthening alternative procurement channels and diversifying raw material sources. Specifically, we are gaining flexibility by conducting spot procurement from Chinese port inventories, increasing procurement from nearby sources such as Indonesia, making advance purchases, and increasing the number of contracts for different grades shipped from unaffected regions of Australia. In addition, we are mitigating risks of supply interruptions by stockpiling raw materials at Philippine Sinter Corporation, a Group company, and using external yards. In addition, JFE Steel has acquired a 10% interest in the Blackwater coal mine owned by Australian steelmaking coal supplier Whitehaven Coal Limited. This is a key means for securing the stable procurement of high-quality raw materials amid increasing difficulty in developing or expanding new steelmaking coal projects.

As the decarbonization of steelmaking processes is expected to foster the diversification of required raw materials, we will continue developing and diversifying procurement sources for those raw materials with due consideration for climate change risks.

FOCUS Key Factor (6) Damage to Production Bases and Offices Caused by Climatic Hazards

Damage to manufacturing bases from typhoons, heavy rain, and drought

Short term (2027) Medium term (2035) Long term (2050)

We are taking action to minimize damage with the assumption that typhoons and heavy rains will become stronger and that the incidents of disasters comparable to the torrential rain in Western Japan in 2018 will rise. JFE Steel has already implemented flood and drought countermeasures at production sites to minimize the impact of climate-related hazards, and at this point, no significant impacts are anticipated.

Specifically, we have invested approximately 6.5 billion yen in flood disaster prevention at steelworks and completed upgrades to drainage facilities and other precautions. In addition, we have invested approximately 3.5 billion yen in drought countermeasures and introduced seawater desalination equipment at several steelworks. Since the drought disaster of 1994, no severe comparable events have occurred, and we are confident that existing countermeasures are sufficient to maintain stable operations even if their frequency increases.

Furthermore, since all of our steelworks are located along the coast, inundation risks from rising sea levels must also be taken into account. However, the anticipated sea level rise of about 20-30 cm by around 2050 (70 cm by 2100 at the extreme impact of climate change) is not at the scale at which storm surge inundation would occur. Going forward, we will continue to analyze the status of climate-related hazards and strengthen required countermeasures.

FOCUS Key Factor (7) National Resilience

Strengthened infrastructure and disaster measures

Short term (2027) Medium term (2035) Long term (2050)

The JFE Group takes seriously the increased frequency and severity of recent climatic hazards in Japan and overseas. Having one’s daily life put in danger is a huge risk. It is our mission to promote disaster prevention and mitigation as well as national resilience to maintain vital infrastructure that is essential to daily life and economic activities.

The JFE Group is able to draw upon its collective strengths to contribute in many ways—for example, by protecting key structures from earthquakes using structural steel such as high-strength H-shaped steel and steel pipe piles as well as steel sheet piles, reinforcing embankments that are prone to bursting, and providing disaster prevention products such as hybrid tide embankments and permeable steel slit dams. Our engineering business can also handle a wide range of infrastructure construction projects, including bridges, gas, water and sewage, and pipelines.

Links to information about the JFE Group Environmental Vision for 2050 and Climate Change Scenario Analysis

- Commitment to a Low Carbon Society:Policy Engagement

- Targets and Results Related to Climate Change:FY2024 KPI Results and FY2025 KPIs

- Initiatives on Climate Change:Initiatives to Address Climate Change Issues