Corporate Governance

Basic Policy

With the steel business, engineering business and trading business at its core, the JFE Group develops a broad range of businesses in a wide range of areas together with many group companies and partners. Establishing a proper governance system is essential toward improving independence and raising efficiency in each operating company, along with the optimal management of risks, which include those related to the environment, safety, and disaster prevention in the Group. It is also necessary for the sustainable growth of the Group and the medium- to long-term improvement of its corporate value.

We have also established the JFE Holdings, Inc. Basic Policy on Corporate Governance to express concretely the JFE Group’s Corporate Vision of pursuing best practices in corporate governance and achieving further development in this area.

Results

Major topics discussed during FY2023 Board of Directors meetings included the following.

- Progress of the Seventh Medium-term Business Plan

- Large-scale capital expenditures (expansion in production facility for grain-oriented electromagnetic steel sheets, other)

- Overseas business development (grain-oriented electrical steel sheet joint venture with JSW Steel Limited, India)

- ESG initiatives (e.g., efforts to achieve carbon neutrality, assessment and review of KPIs for material issues of corporate management)

Selected governance data can be accessed from the following link.

Systems and Initiatives

Corporate Governance System

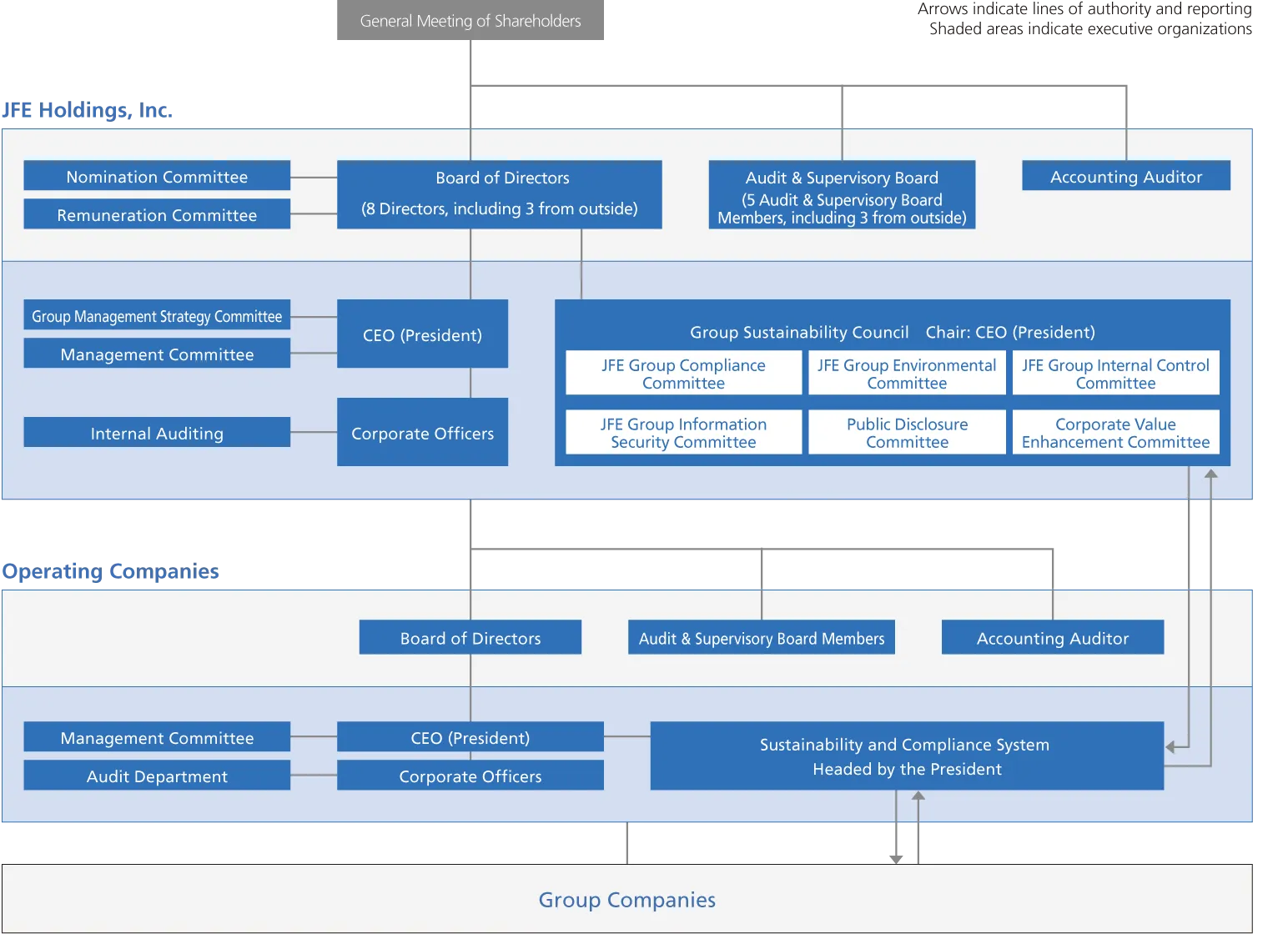

Group Governance System

The JFE Group comprises a holding company and three operating companies, JFE Steel, JFE Engineering, and JFE Shoji.

JFE Holdings, a pure holding company at the core of the Group’s integrated governance system, guides Group-wide strategy, risk management, and public accountability.

Each operating company has developed its own system suited to its respective industry, ensuring the best course of action for competitiveness and profitability.

Governance System

Major Initiatives to Strengthen the Governance System

Duties of the Board of Directors and other Bodies

Selection of Independent Outside Directors

Independent Outside Directors comprise at least one-third of the total number of Directors. Independent Outside Directors are elected from nominees who can be expected to bear responsibility for strengthening governance, including those with proven experience in managing a global enterprise or who possess expertise and deep knowledge and satisfy our independence standards. Currently, six of the thirteen Directors are Independent Outside Directors.

Approach to Diversity in the Board of Directors

With regard to the composition of the Board of Directors, the Company elects officers following deliberations by the Nomination Committee by focusing on the enhancement of diversity of the Board members, such as their expertise, knowledge and experience in various fields, while balancing with the appropriate size of the Board. Two female Directors are currently in office. The Company also elects Directors who possess a wealth of knowledge and experience as management in global enterprises. In this way, the Company is working to enhance gender and global diversity. The company will continue to systematically engage in initiatives to foster such human resources suitable for candidates for Directors by setting specific targets.

Skill Matrix of Directors

We have established the JFE Holdings, Inc. Basic Policy on Corporate Governance for promoting sustainable growth of JFE Holdings, Inc. and the JFE Group, the medium- to long-term improvement of corporate value, and expressing concretely the JFE Group’s Corporate Vision of pursuing best practices in corporate governance and achieving further development in this area. With regard to the composition of the Board of Directors, we strive to enhance the diversity of the Board members, such as their expertise, knowledge, and experience in various fields, and identify necessary skills of corporate management in light of our business and corporate management issues. The Company elects officers following deliberations by the Nomination Committee while balancing with the appropriate size of the Board.

The skill matrix of each Director against identified skills in light of their knowledge, experience, and expertise are summarized below.

| Name | Corporate management / Management strategy | Sustainability / Environment | Technology / DX | Finance / Accounting | Internal control / Governance | Legal / Compliance | Personnel and labor / Human resources development | Sales / Marketing | Operation with knowledge | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Directors | Inside | Yoshihisa Kitano | ● | ● | ● | ● | Steel | ||||

| Masayuki Hirose | ● | ● | ● | ● | Steel | ||||||

| Masashi Terahata | ● | ● | ● | ● | ● | ● | Steel / Trading | ||||

| Kazuyoshi Fukuda | ● | ● | ● | ● | ● | Engineering | |||||

| Yoshifumi Ubagai | ● | ● | ● | ● | Steel / Trading | ||||||

| Outside | Yoshiko Ando | ● | ● | ● | ● | - | |||||

| Takuya Shimamura | ● | ● | ● | ● | - | ||||||

| Keiichi Kobayashi | ● | ● | ● | ● | ● | - | |||||

| Directors who are Audit Supervisory Committee Members | Inside | Nobuya Hara | ● | ● | ● | Steel | |||||

| Nakaba Akimoto | ● | ● | Steel / Engineering / Trading | ||||||||

| Outside | Tsuyoshi Numagami | ● | ● | ● | ● | - | |||||

| Yoshihisa Suzuki | ● | ● | ● | ● | ● | - | |||||

| Naoto Nakamura | ● | ● | ● | - | |||||||

Nomination Committee and Remuneration Committee

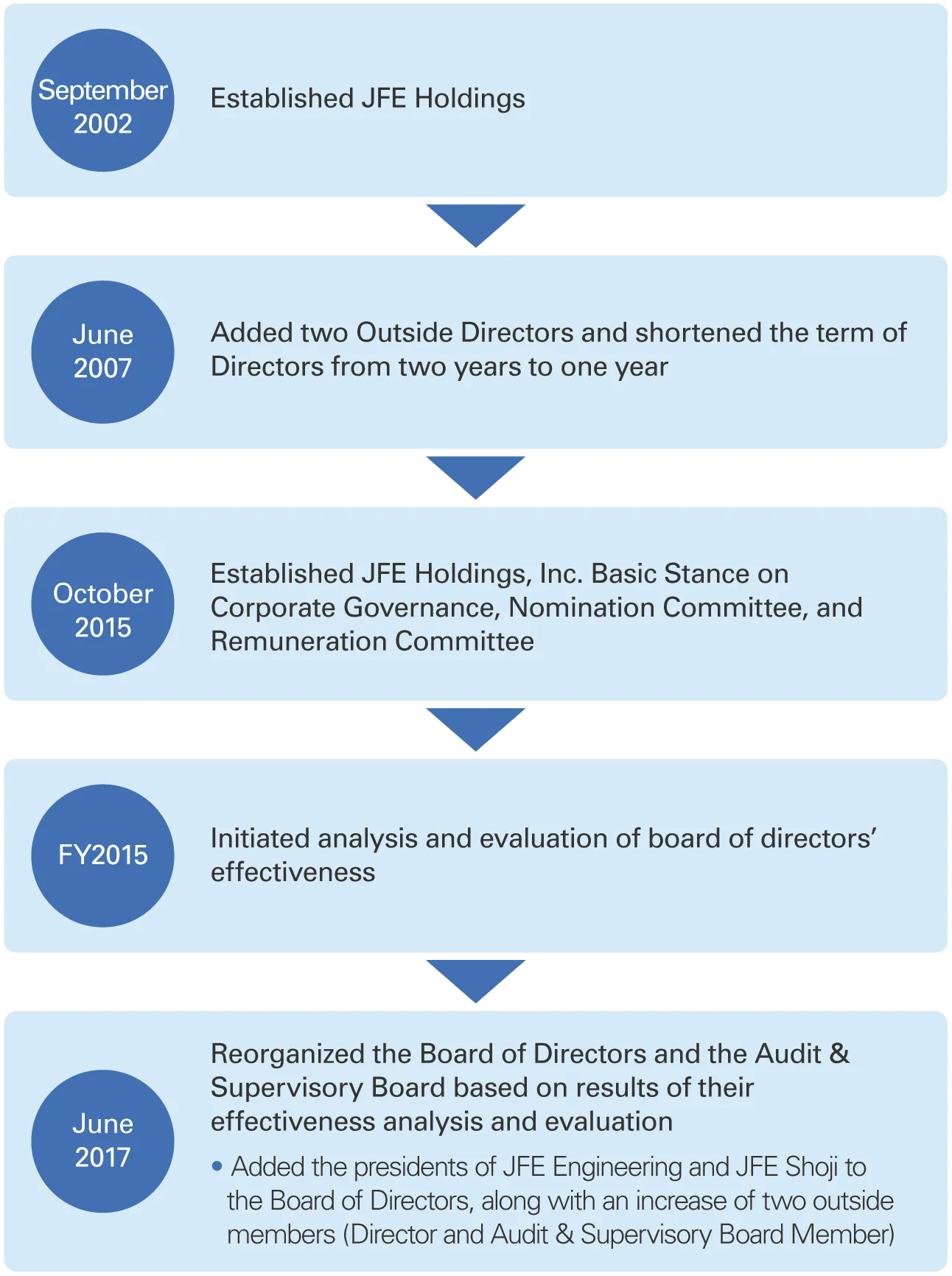

JFE Holdings has maintained the Nomination Committee and the Remuneration Committee since October 2015 as advisory bodies to the Board of Directors to secure fairness, objectivity, and transparency in the appointment of and remuneration for Directors. For both committees, the majority of committee members are Outside Directors and the chairs are chosen from among these people.

The Nomination Committee deliberates and reports to the Board of Directors on matters pertaining to the basic policies related to the President of the Company, including election and dismissal, selection of candidates, and succession plans in addition to the nomination of candidates for Outside Directors and Outside Audit & Supervisory Board Members. (Six meetings were held in FY2023, all with 100% attendance.) The Remuneration Committee deliberates on matters pertaining to the basic policy on the remuneration of Directors, etc., of the Company and each operating company and reports to the Board of Directors. (Three meetings were held in FY2023, all with 100% attendance.)

Support for Directors

Directors are provided with opportunities and funding to receive training in legal matters, corporate governance, risk management, and other subjects that help them fulfill their roles and duties.

In addition, a briefing is held for Outside Directors prior to Board of Directors meetings.

Furthermore, Outside Directors are provided with relevant information and opportunities to exchange opinions with the president and other top managers, attend key hearings on the operational status of individual departments, and inspect business sites and Group companies inside and outside Japan.

Analysis and Evaluation of the Effectiveness of the Board of Directors

Since FY2015, JFE Holdings has been evaluating the overall effectiveness of its Board of Directors based on its Basic Policy on Corporate Governance. Since FY2018, a third party has been conducting the analysis and evaluation to ensure objectivity. In FY2023, we conducted a questionnaire with all Directors and Audit & Supervisory Board Members.

Furthermore, we examined the results of our efforts in FY2023 to reflect the opinions and recommendations of the FY2022 evaluation.

Based on the discussions by the Board of Directors in light of the survey results and evaluation by the third-party organization, it was determined that the overall effectiveness of the Board has been ensured through vigorous discussions among members supported by sufficient preliminary briefings at the meeting for Outside Directors/Audit & Supervisory Board Members as well as by appropriate management and leadership by the chairperson.

The FY2023 initiatives reflecting the results of the effectiveness of evaluations up to FY2022 include the following.

- Apart from revising KPIs on diversity and inclusion and human resource development, we also discussed the awareness surveys on corporate ethics that have been conducted until recently. In addition, we reported the results of the engagement survey and our response to the Board of Directors in an effort to deepen our discussion on human capital management.

- We reported on the status of our initiatives on carbon neutrality and human rights due diligence at the Board of Directors meetings to confirm progress and encourage discussion on the challenges ahead. We also reported on issues related to sustainability and risk management, including the Group’s approach to BCP as well as its approach to and policies on biodiversity, to enhance Board discussions.

- We improved reporting on risk information and management initiatives at the operating companies and Group companies. We also revised the frequency of our surveys on awareness of corporate ethics and related issues to more thoroughly instill awareness about corporate compliance and prevent risks from materializing. We continue to improve Group-wide risk management in accordance with discussions at Board of Directors meetings.

In addition to accurate and fair audits performed by the Audit & Supervisory Board Members, the members also express opinions and actively ask questions at Board of Directors meetings on management decisions and reports to further invigorate deliberations. Such outcomes supported the conclusion that JFE functions efficiently as a company with an Audit & Supervisory Board.

Furthermore, the following main issues were extracted from this survey for further improvement of effectiveness.

- Sustainable corporate growth depends upon considering the ideal state of the Group and its long-term strategies while at the same time further deepening discussions on human capital management and respect for human rights as well as other material management issues.

- From the perspective of enhancing corporate value, we must organize the agenda items for Board of Directors meetings to establish a balance between speedy decision-making with supervisory functions. We must also continue to consider the governance structure, including ways to further enhance diversity.

- To further strengthen risk management across the entire Group, we must continuously consider ways to develop our reporting of risk information, including that of subsidiaries and affiliates, to the Board of Directors.

In FY2024, we will continue to enhance the sharing of opinions between the Board of Directors and the executive members of operating companies. These efforts will include holding Board of Directors meetings at domestic operating companies and field visits by the Board members to domestic and overseas operating companies.

Given these issues, we will proactively implement initiatives to increase the effectiveness of the Board of Directors and enhance the Group’s corporate value.

Operating System

Key Decision-Making

JFE companies are responsible for business decisions in accordance with their respective rules and procedures, whereas JFE Holdings makes decisions about Group-wide matters. Each operating company determines key matters through a deliberative process by its own Management Committee and Board of Directors. In April 2017, JFE Holdings changed the operating structure of key committees. Management strategies involving the entire group are now deliberated by the Group Management Strategy Committee and core issues of JFE holdings, the operating companies and the Group are deliberated by the Management Committee before they are submitted to the Board of Directors for resolution.

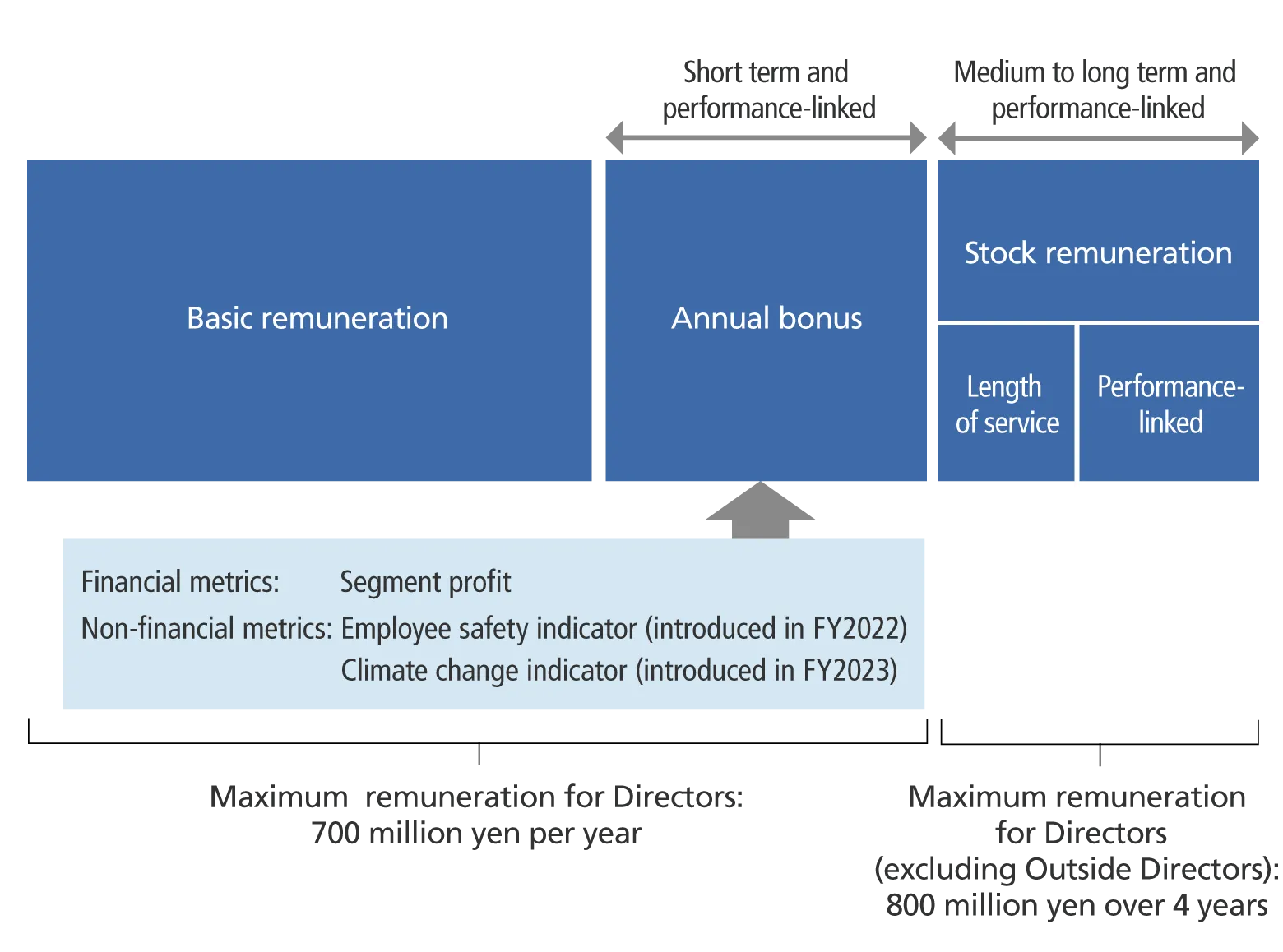

Executive Remuneration

Executive remuneration is based on the Basic Policy on Remuneration for Directors and Corporate Officers and the Policy for Deciding the Individual Remuneration for Directors and Corporate Officers founded on discussions and reports by the Remuneration Committee, and it is decided through either a resolution of the Board of Directors or deliberations by the Audit & Supervisory Board Members, for an amount within the total limit approved at the General Meeting of Shareholders.

Outline of Policy for Deciding the Individual Remuneration for Directors and Corporate Officers

- The Board of Directors shall determine remuneration system for Directors and Corporate Officers based on deliberations regarding its appropriateness by the Remuneration Committee to ensure fairness, objectiveness, and transparency.

- The remuneration level for Directors and Corporate Officers shall be determined to secure excellent human resources who are able to put the Group’s corporate vision into practice, taking into consideration the business environment of the Group and remuneration levels at other companies in the same industry or of the same scale.

- The ratio between basic remuneration and performance-linked remuneration (annual bonus and stock remuneration) shall be properly established according to the roles and responsibilities, etc., of each Director and Corporate Officer so as to function as sound incentives toward the sustainable growth of the Group.

Outline of Policy for Deciding the Individual Remuneration for Directors and Corporate Officers

- Remuneration for Directors and Corporate Officers shall be determined by a resolution of the Board of Directors in accordance with the Basic Policy and the Decision Policy, based on reports from the Remuneration Committee.

- Remuneration for the Directors and Corporate Officers is comprised of basic remuneration and performance- linked remuneration (annual bonus and stock remuneration).

- Basic remuneration is paid as a fixed amount, in cash, each month according to position.

- An annual bonus is linked to the Company’s single-year performance (calculated based on financial and non- financial indicators) and is paid in cash once a year.

- Stock remuneration is granted as the Company’s shares and cash equivalent to the amount of the Company’s shares converted to market value through the trust upon retirement.

- The ratios of remuneration by type are structured so that the higher the position, the greater the weight of performance-linked remuneration, and the ratio for the company’s President when performance target goals have been attained is set so that the ratio of basic remuneration, annual bonus and stock remuneration stands at 6:2:2.

The Company pays only basic remuneration to Outside Directors and Audit & Supervisory Board Members, given their roles of supervising and auditing management from an independent and objective standpoint. Directors who concurrently serve as Executive Directors of operating companies shall not be paid the Stock Remuneration from the Company.

Performance-linked remuneration is calculated as follows.

Annual bonus

Annual bonuses are calculated by taking the total segment profit for a single fiscal year and indicators related to employee safety and climate change as the performance-linked indicators and multiplying the level of achievement of these indicators by a given coefficient for each position.

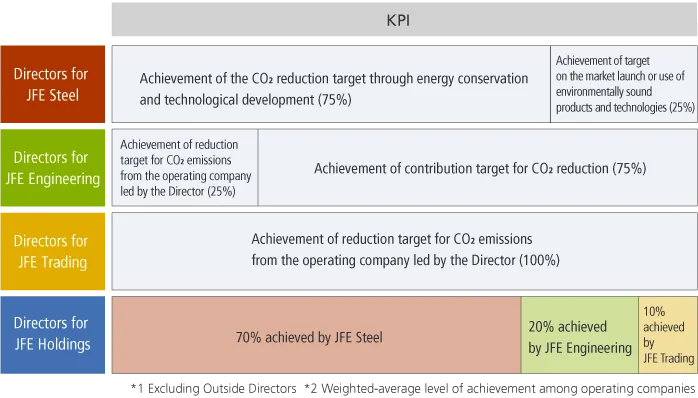

We introduced one non-financial indicator related to employee safety in FY2022 and one related to climate change in FY2023. The employee safety indicator depends on the level of achievement of KPIs set for the operating company concerned, such as zero work fatalities and target lost-work injuries rate. The climate change indicator depends on the level of achievement of KPIs selected for the operating company concerned from “Contribute to resolving climate change issues (initiatives for achieving carbon neutrality by 2050).” (See the following diagram.) Directors and Corporate Officers who have been dismissed or have committed any misconduct may lose the right to receive benefits based on a resolution of the Board of Directors. Directors and Corporate Officers who have already received benefits may be asked to return the amount based on a resolution of the Board of Directors if they engage in any misconduct.

Stock remuneration

Under the stock remuneration plan, a payment level is determined based on performance targets set in the Seventh Medium-term Business Plan of the Group. From FY2021 to FY2024, the payment level is determined according to the level of achievement of the target profit attributable to owners of the parent company of 220 billion yen per year, set under the Seventh Medium-term Business Plan. Furthermore, 5% or more return on equity attributable to owners of parent (ROE) is the minimal requirement for the payment.

Directors and Corporate Officers who have been dismissed or have committed any misconduct may lose the right to receive benefits based on a resolution of the Board of Directors. Directors and Corporate Officers who have already received benefits may be asked to return the economic value equivalent to the Company’s shares already received, based on a resolution of the Board of Directors if they engage in any misconduct.

To achieve sustainable corporate growth for the Group, the Remuneration Committee and the Board of Directors continue to improve the remuneration system for Directors to serve as an incentive with a higher level of integrity.

Design of the Remuneration Plan for Directors

Conversion Rates (Achievement of Climate Change Indicators)

Internal Control

The JFE Group’s internal control system, in accordance with the Basic Policy for Building an Internal Control System, is maintained through various committee regulations including the Rules of the Board of Directors, Regulations for Group Management Strategy Committee, Regulations for Management Committee, Regulations for the JFE Group Sustainability Council, Regulations for Organization and Operations, Regulations for Document Management, Regulations for Addressing Violence Directed at Companies, and a Corporate Ethics Hotline. We revise and improve the Basic Policy from time to time to boost sustainable corporate value.

Strengthening Internal Control

Internal Audits

JFE Holdings, its major operating companies, and key Group companies have internal audit organizations comprising 168 people as of April 1, 2024. These organizations share information to enhance overall auditing within the Group. They also report internal audit findings to the Board of Directors as well as to the Audit & Supervisory Board to maintain the effectiveness of internal audits.

To ensure the proper implementation of sustainability activities, the JFE Group assesses environmental management, Antimonopoly Law compliance, measures taken to prevent the bribery of public officials, expense management, overseas office management, tax law compliance, safety management, and disaster prevention by systematically including these areas in business operation audits conducted by the internal auditing department. If an audit finds an issue or problem, the internal audit departments of JFE Holdings and the operating company work together to share the information across the Group and incorporate lessons learned in sustainability activities conducted by the Group’s companies.

Audits by Audit & Supervisory Board Members

JFE has an Audit & Supervisory Board composed of five Members including three Outside Audit & Supervisory Board Members. Apart from attending the meetings of the Board of Directors, duties are shared between full-time and part-time Audit & Supervisory Board Members to attend meetings of the Group Sustainability Management Strategy Committee, Management Committee, and Group Sustainability Council, among other important meetings, and express opinions as appropriate. To audit the execution of Directors responsibilities, they engage in activities such as conducting hearings with Directors and Corporate Officers regarding operational status and receiving operational reports from operating companies and Group companies. In addition to undergoing statutory audits, JFE companies take the following initiatives to strengthen coordination among Audit & Supervisory Board Members by sharing information and ensuring the effectiveness of internal auditing by the Audit & Supervisory Board Members.

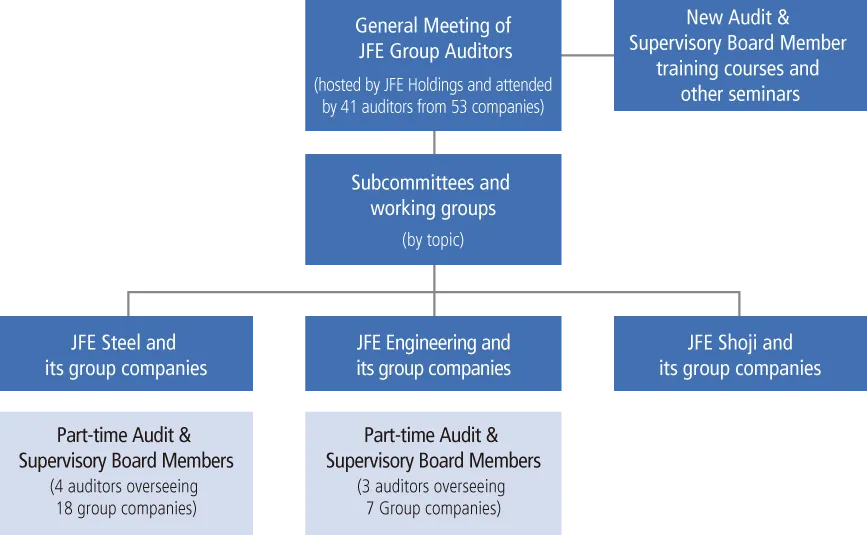

A total of 34 full-time Audit & Supervisory Board Members have been appointed to 29 companies, including JFE Holdings. Operating company personnel are dispatched to Group companies as part-time Outside Audit & Supervisory Board Members. Each dispatched Audit & Supervisory Board Member serves one to five subsidiaries to perform audit and enhance Group governance. Seven Audit & Supervisory Board Members served 25 companies in total.

The JFE Group Board of Auditors includes both full-time Audit & Supervisory Board Members of each Group company and part-time Audit & Supervisory Board Members. Subcommittees and working groups created to address specific issues meet autonomously to share information, investigate issues and enhance understanding. The findings of the year’s activities are presented at the general meeting of JFE Group Auditors and used for audits.

Structure of JFE Group Board of Auditors

Cooperation between Audit & Supervisory Board Members and Accounting Auditor

In FY2023, the Audit & Supervisory Board Members held eight scheduled or unscheduled meetings with Ernst & Young ShinNihon, JFE’s outside accounting auditor, in which the latter presented its audit plan, completed work and detailed results. The firm also presented a detailed explanation of its quality management system to confirm its validity. In turn, the Audit & Supervisory Board Members explained their own audit plans and other matters to the firm. The two sides also shared opinions on related matters.

Cooperation between Audit & Supervisory Board Members and Internal Auditing Department

In FY2023, the Audit & Supervisory Board Members held ten scheduled or unscheduled meetings with the internal auditing department, in which the latter presented its internal audit plan, work status and detailed results. During the meetings, the Audit & Supervisory Board Members also shared opinions with the department.

Operating Company Governance

Some Directors, Corporate Officers, and Audit & Supervisory Board Members of JFE Holdings serve concurrently as the Directors or Audit & Supervisory Board Members of operating companies to strengthen governance and information sharing across the Group. To strengthen governance, JFE Holdings’ managers attend each operating company’s General Meeting of Shareholders and Management Planning Briefing, receive reports on their activities, and discuss the managerial policies of subsidiaries.

Policy on Listed Subsidiaries and Listed Affiliates

-

Significance of having listed subsidiaries and affiliates based on group management approach and policies

To put into practice the Group’s corporate vision of contributing to society with the world’s most innovative technology, and also to realize sustainable growth and enhancement of medium- to long-term corporate value, the JFE Group forms corporate groups comprising companies with high expertise, divides business functions within the Group, and conducts businesses development outside of the Group. Within these groups, JFE Steel Corporation, a subsidiary of the Company, owns one listed subsidiary and four listed affiliates described below.

For the listed subsidiary among them, the Company seeks an optimal structure based on the business relationship with JFE Steel Corporation, its parent company, and maintains its listing based on a comprehensive judgement that listing is necessary for the company’s growth and increasing the value of the Group as a whole, from the perspective of market recognition and credibility in funding, sales and marketing, and hiring.

In addition, the four listed affiliates maintain their listing as a means to enhance their competitiveness from the perspectives of market recognition and credibility in funding, sales and marketing, and hiring. JFE Steel Corporation holds some shares in the four companies because of associated benefits such as the exchange of steel manufacturing-related technologies and human resources.

Listed Subsidiary

JFE Systems, Inc. (Tokyo Stock Exchange, Standard Market)

The main business of JFE Systems includes system integration consisting of planning, designing, development, operation, and maintenance of information system, system construction utilizing solutions, and the company’s own products, and IT infrastructure solutions that support the business system. Computer systems are an important foundation in the steel business that support overall business activities, including order acceptance, production, shipment, and quality management, and in using a variety of data. Guaranteeing the accumulation of know-how and the continuation of personnel exchanges by holding JFE Systems as a subsidiary will also be indispensable for maintaining the competitiveness of JFE Steel in pressing ahead with digital transformation.

JFE Systems, Inc.’s predecessor, Kawasaki Steel Systems R&D Corporation, was listed on the 2nd Section of the Tokyo Stock Exchange in March 2001. As of March 31, 2024, the JFE Group holds 67.9% shares of JFE Systems, Inc.

Listed Affiliates

Gecoss Corporation (Tokyo Stock Exchange, Prime Market)

Gecoss Corporation is mainly engaged in the rental and sales of temporary construction materials, as well as in design and construction of temporary works, etc. Gecoss Corporation’s predecessor, Kawasho Lease System Co., Ltd., was listed on the 2nd Section of the Tokyo Stock Exchange in August 1994 and was subsequently reassigned to the 1st Section of the Tokyo Stock Exchange in September 1996.

Furthermore, Gecoss Corporation used to be a subsidiary of JFE Steel Corporation, but it was determined that further enhancing Gecoss Corporation’s independence as well as strengthening its existing business and creating new business opportunities through a capital and business alliance with Mizuho Leasing Company, Limited would contribute to increasing the corporate value of the company and the JFE Group. As such, some shares of Gecoss Corporation were sold to Mizuho Leasing Company, Limited in May 2024. The JFE Group as a whole currently holds 39.5% shares of the company.

Shinagawa Refractories Co., Ltd. (Tokyo Stock Exchange, Prime Market)

Shinagawa Refractories Co., Ltd. is mainly engaged in the manufacture and sale of refractories as well as engineering services such as furnace design and construction. Shinagawa Shirorenga, the predecessor of the company, was listed on the 1st Section of the Tokyo Stock Exchange in May 1949 and subsequently became an affiliate of JFE Steel Corporation. As of March 31, 2024, the JFE Group holds 34.9% shares of Shinagawa Refractories Co., Ltd.

Nippon Chuzo K.K. (Tokyo Stock Exchange, Standard Market)

Nippon Chuzo K.K. is mainly engaged in the formed and fabricated materials business to manufacture a variety of casting products and the engineering business to design and manufacture bridge components, etc. The company was listed on the 2nd Section of the Tokyo Stock Exchange in October 1961. As of March 31, 2024, the JFE Group holds 36.2% shares of Nippon Chuzo K.K.

NIPPON CHUTETSUKAN K.K. (Tokyo Stock Exchange, Standard Market)

NIPPON CHUTETSUKAN K.K. is mainly engaged in the manufacture and sale of ductile iron pipes and polyethylene pipes, as well as water pipe laying works. The company was listed on the 2nd Section of the Tokyo Stock Exchange in July 1962 and subsequently became an affiliate of JFE Steel Corporation. As of March 31, 2024, the JFE Group holds 30.0% shares of NIPPON CHUTETSUKAN K.K.

The aforementioned five companies are subject to rules different from those applicable to other consolidated subsidiaries and affiliates based on the guidelines of the Ministry of Economy, Trade and Industry and the Tokyo Stock Exchange regarding listed subsidiaries, and other measures are also taken so as to ensure that each of the companies conducts autonomous corporate activities exercising autonomy and flexibility. Each company also secures management independence as listed companies mainly by appointing outside directors who are independent from each company, JFE Steel Corporation and the Company and by establishing special committees composed of independent members such as independent outside directors, and makes sure that the interests of the said subsidiary or affiliate, as well as the interests of shareholders of the subsidiary or affiliate other than the Company, will not be unfairly impaired.

With regard to the adjustment and allocation of business opportunities and business areas for the listed subsidiary and affiliates, the Company respects autonomous management decisions made by each company, except in cases where such decisions have a significant impact on the Company’s consolidated financial statements.

In addition, each company independently raises and manages funds based on its own financial strategy. Although the Company receives fund deposits from the listed subsidiary, the transaction terms are determined rationally in consideration of market interest rates, etc.

With respect to matters necessary for the Group’s risk management, prior consultation and reporting are required from each company while securing their independent decision-making, so as to implement risk management as a member of the Group companies.

-

Measures to ensure the effectiveness of governance systems at listed subsidiaries and affiliates

Each company independently formulates its own proposals regarding the nomination of officers. JFE Steel Corporation fully respects the independence of each company and the decisions made by each company’s nomination committee, and exercises its voting rights with the aim of improving each company’s corporate value in the medium to long term.

To maximize the benefits of technological and personnel exchanges with each company, the Company and JFE Steel Corporation may recommend director candidates in some cases.

Furthermore, we shall regularly verify the significance of maintaining the listing of the listed subsidiaries and take necessary measures upon confirmation at its Board of Directors. The above details were verified and discussed at a Board of Directors meeting in May 2024.

Basic Policies for Strategic Shareholdings and Exercise of Related Voting Rights

All shares held by the Company are the shares of subsidiaries or affiliates. In principle, the Company’s wholly owned subsidiaries and operating companies, JFE Steel Corporation, JFE Engineering Corporation and JFE Shoji Corporation (hereinafter “Operating Companies”), do not hold domestic listed stocks as strategic shareholdings. Strategic shareholdings, however, are allowed as an exception when holding the stocks of the Company is determined to be necessary for maintaining and achieving growth for the Group.

The Board of Directors regularly confirms the relative value of the strategic shareholdings and whether the benefits and risks of such holdings are commensurate with their capital cost, and sell shareholdings that are not significant or if there is a risk of damage to shareholder interests. In FY2023, the Company sold all or part of 30 stocks for 21.6 billion yen (market value). Furthermore, the Board of Directors regularly examines the significance of strategic holdings and the return on investment.

The exercise of voting rights of strategic shareholdings is decided upon reviews by operating companies on the content of the proposal and is appropriately implemented in a way that will maximize shareholder interest. To be specific, the content of the proposal is to be checked by the investment application department and the investment control department, and approval will be given to proposals which are considered not to pose any threat to the maximization of interest of these operating companies as shareholders.

Of the shares for investment purposes held by JFE Steel, which has the largest balance sheet amount for investment purposes posted in the consolidated financial statements of the company, those shares of the company held for purposes other than pure investments are shown below.

Number of Issues and Amount Reported in the Balance Sheet

| FY2019 year-end | FY2020 year-end | FY2021 year-end | FY2022 year-end | FY2023 year-end | |

|---|---|---|---|---|---|

| Number of issues | 219 | 171 | 146 | 138 | 127 |

| Total balance sheet amount (billion yen) | 166.1 | 96.0 | 71.2 | 59.0 | 60.8 |